July 2018 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on August 16th, 2018

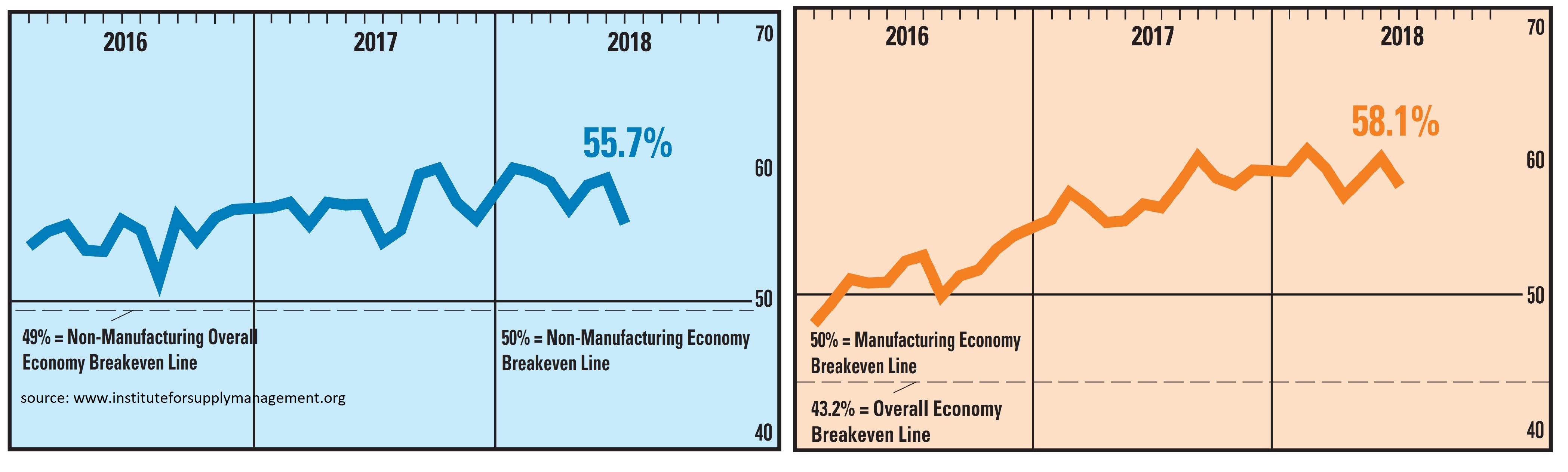

Economic output seems to have moderated in July 2018 according to the latest from the Institute for Supply Management. Both of their indices (representing manufacturing and services) pulled back from rather elevated levels as the second half of the year got underway. However, output is still growing even if it is decelerating.

Manufacturing had been running quite hot, so the recent cooldown is not alarming. Readings above 50 suggest an expanding economy and are acceptable; readings beyond 55 are robust. July’s tally was still 58.1 after hitting 60.2 in June. Delivery improvements were the primary driver behind the decline as firms experienced fewer delays receiving orders. For some context, deliveries were the most stressed in the 70-year history of this indicator in the prior period. Looking forward, new orders remained strong with another reading above 60 which should keep this side of the economy expanding in the months ahead.

Their reading on services ticked lower also, but at 55.7, is still looking strong. New orders declined to 57.0, dropping five points. Backlogs dipped the same amount to end July at 51.5. Exports fell to 58.0, giving back 2.5 points. Business activity fell pretty hard, reaching 56.5 from 64.0 in June. This may not bode well for third-quarter gross domestic product.

Our economy was running pretty hot in June, so July’s more moderate pace could be a positive. If output gets too far ahead relative to capacity, inflationary pressures can build which might cause the central bank to intervene with faster interest rate hikes, possibly hastening the next recession. However, if capacity and demand can find equilibrium without the Fed’s exogenous intervention, then the current expansion probably stands a better chance of continuing in the quarters ahead.