Job Hopping

Submitted by Atlas Indicators Investment Advisors on October 21st, 2018

Job Hopping

We recently wrote regarding the unemployment statistics for September. You can read the entire blog here. The headline showed the unemployment rate ticked down to 3.7 percent, its lowest level since 1969. Additionally, in September net new jobs (new hires minus quits and layoffs) increased by 134,000 with substantial upward revisions to both the July and August numbers as well.

The Bureau of Labor Statistics has a monthly report called Job Openings Labor Turnover Survey (JOLTS) which contains more data about the employment situation but with a one month lag. The most recent release showed the U.S. has a record 7.14 million job openings as of August. Compare that to the 6.23 million people our government says were unemployed in August. Pretty weird. In fact, job openings have been exceeding the number of unemployed since March 2018, which was the first time we have ever seen that happen.

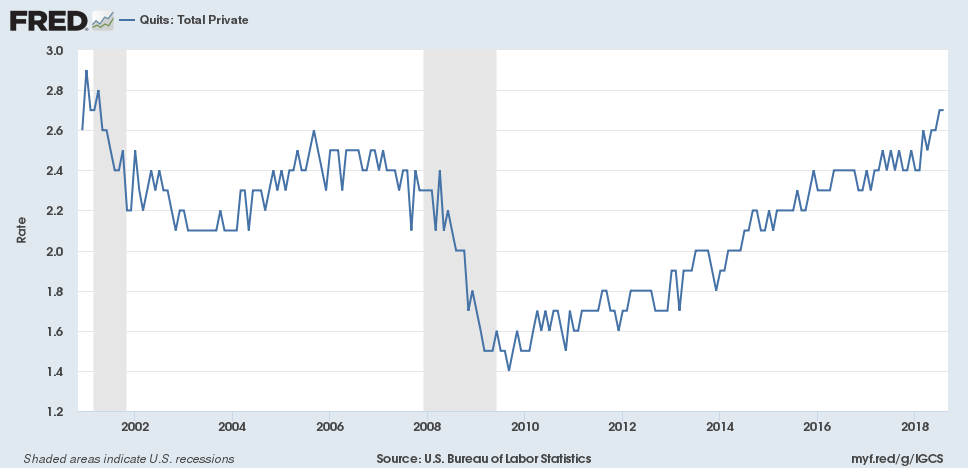

Putting a sharper pencil on it, roughly 5.78 million people got a job in August while 5.71 million no longer work for the company they reported to in July. This latter figure includes 3.6 million who quit; presumably, the balance was canned. Those folks leaving voluntarily comprise a factor called the quit rate which hit 2.7 percent, a 17 year high within the private sector. Compare that to the 1.5 percent quit rate we saw at the end of the Great Recession in 2009.

Why would so many more people be opting to leave their jobs voluntarily today as opposed to nearly 10 years ago? The general assumption is that they are more optimistic about finding a new and probably higher paying position elsewhere. This is what inflation is made of. Add to that, the dearth of workers to fill today’s available openings and you have a lot of dry kindling. We don’t doubt the Federal Reserve has good reason, at least based on this single statistic, to continue their moderate pace of interest rate hikes in December. (by J R Capps)