January 2024

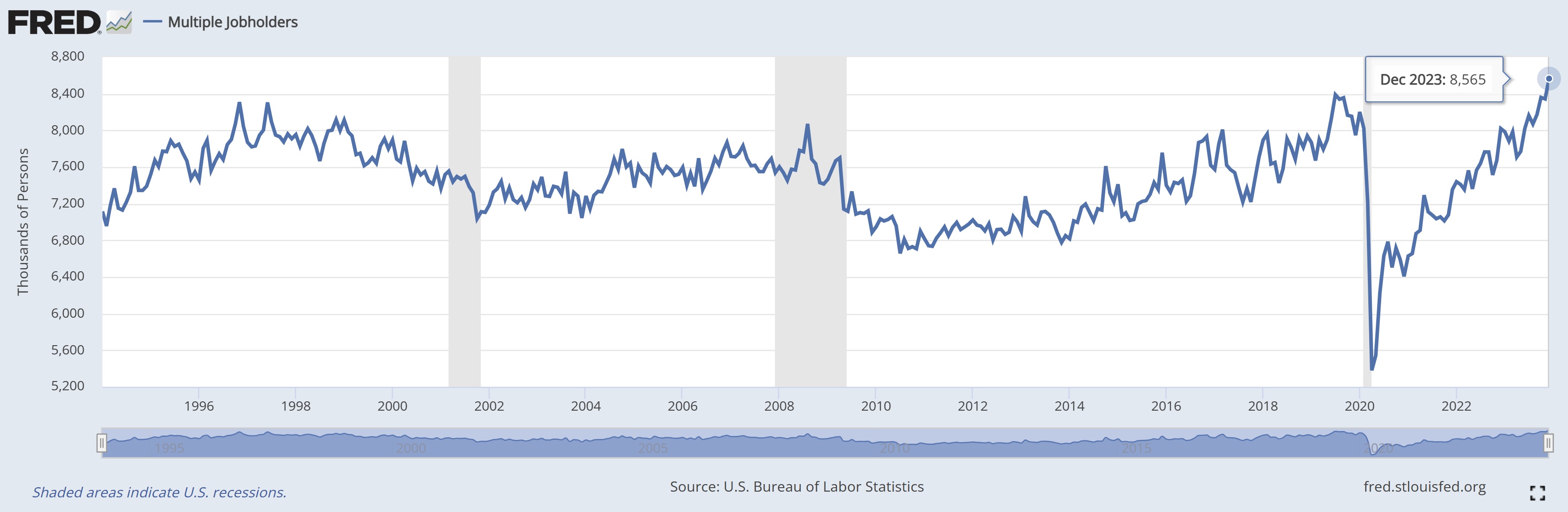

More is Better?

Submitted by Atlas Indicators Investment Advisors on January 31st, 2024

More is an American mantra. When we line up for the all-you-can eat buffet, we want more. When it comes to consumption, we’re the nation responsible for the bumper stick that reads, “He who dies with the most toys wins.” More, as a concept, is endemic in the nation’s culture and doesn’t seem to be becoming unrooted.

Owing for Yesterday’s Pleasure

Submitted by Atlas Indicators Investment Advisors on January 31st, 2024Spending borrowed money can be fun, but paying it back rarely is. However, that is how the financial system works in America. A person looking to spend more than they have available borrows money from another source which has more money than it needs at the same moment in time. This can go on and help fuel an economic expansion for a while but not forever.

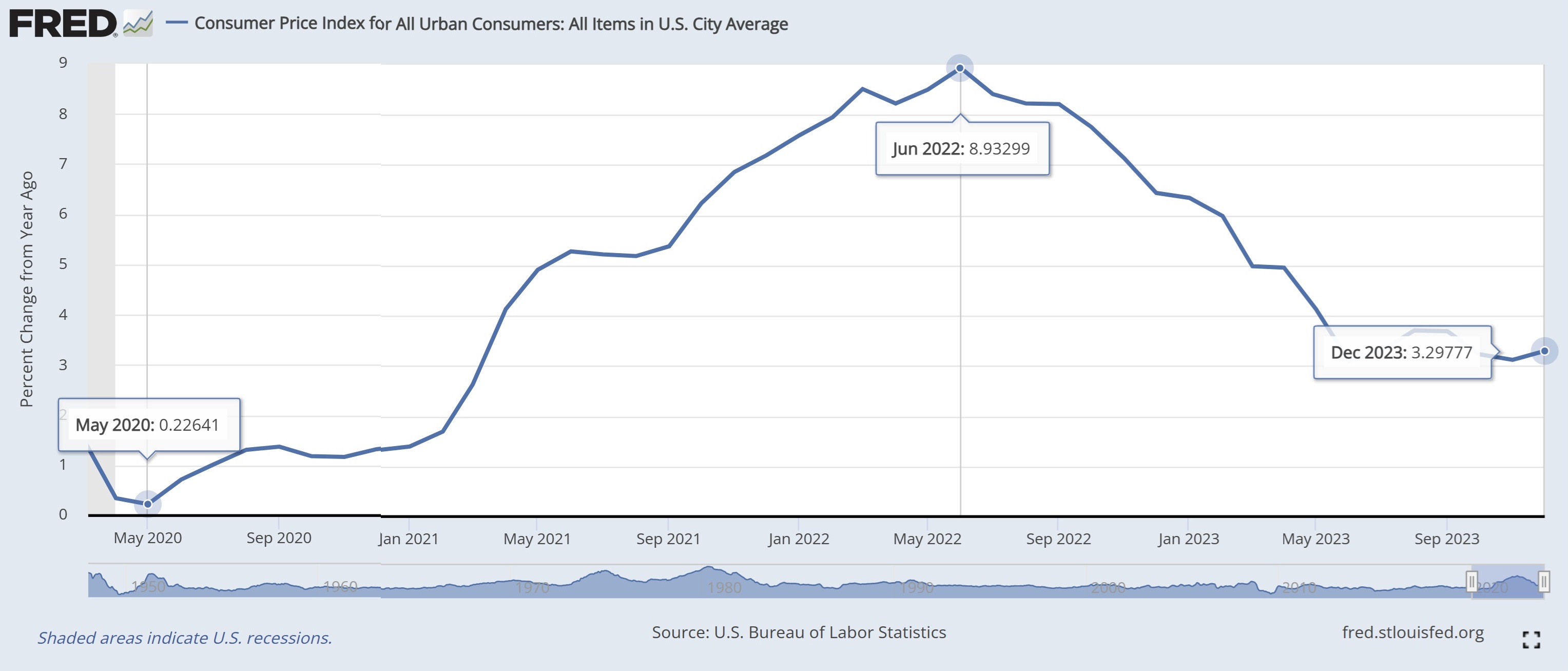

Central Bank 2024 Resolutions

Submitted by Atlas Indicators Investment Advisors on January 31st, 2024New Years offer many an opportunity for resolutions. Perhaps you’ve made a few this year. If you have, let Atlas know if we can help you with any of them. While last Tuesday’s meeting minutes from the Federal Reserve Open Market Committee didn’t exactly serve as a resolution, they do offer some insight into how America’s central bank is thinking about t