More is Better?

Submitted by Atlas Indicators Investment Advisors on January 31st, 2024

More is an American mantra. When we line up for the all-you-can eat buffet, we want more. When it comes to consumption, we’re the nation responsible for the bumper stick that reads, “He who dies with the most toys wins.” More, as a concept, is endemic in the nation’s culture and doesn’t seem to be becoming unrooted.

One thing most people don’t want more than one of is jobs. For most, one job is enough, even if it doesn’t afford the lifestyle they imagined. We don’t get more hours in a day, so having another job is difficult. Despite the 24-hour limit of each day, more Americans than ever have more than one job.

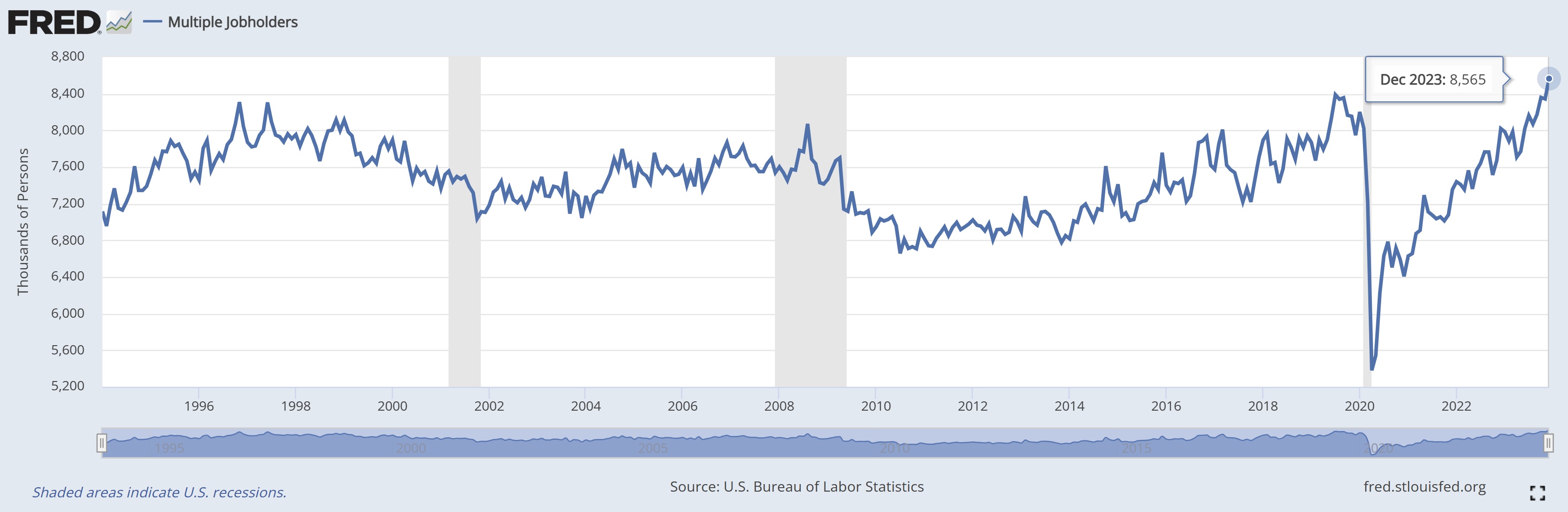

According to data from the Bureau of Labor Statistics, multiple jobholders reached an all-time high at the end of last year. Coming in at 8.565 million, the new record surpassed the previous high of 8.390 million set in July 2019, prior to the global pandemic.

On the surface, this could create more reasons to be concerned about the American labor market. However, taken on its own, the statistics ignores the denominator (multiple jobholder ÷ the number of those employed). If we consider the number of multiple jobholders as a percentage of those employed, the statistic does not look as awful. Click here, and you’ll see that it matches the 2019 high. However, like most stories, there is more to this one as well. As a percentage of employed, the mid 1990s through the turn of this century was worse. Hey, wait! Did we just come up with a way of interpreting the data to suggest more people with multiple jobs is somehow better? Strange.