Coloration Is Not Causation

Submitted by Atlas Indicators Investment Advisors on March 28th, 2025

People like concrete explanations for phenomena. For instance, virtually daily financial headlines are filled with reasons various markets behaved the way they did that day, up or down. These explanations are more compelling to readers than something along the lines of “buyers were more urgent than sellers today, so markets increased after the opposite was true yesterday when markets fell.” But that’s specific to marketplaces. What about in the economy?

Economics is a different beast. Of course, there are variables that explain how the economy is performing. Ever heard of the Hemline Index? Atlas’ President Emeritus, J R Capps, first introduced it to me shortly after we met at our previous firm. In short, this theory was created by George Taylor in 1926 when he noted that the length of hemlines related to how the economy was performing. Shorter hemlines were tied to periods like the Roaring ‘20s and the 1960s (when the miniskirt was created). Meanwhile, longer hemlines tended to be more stylish in times like The Great Depression.

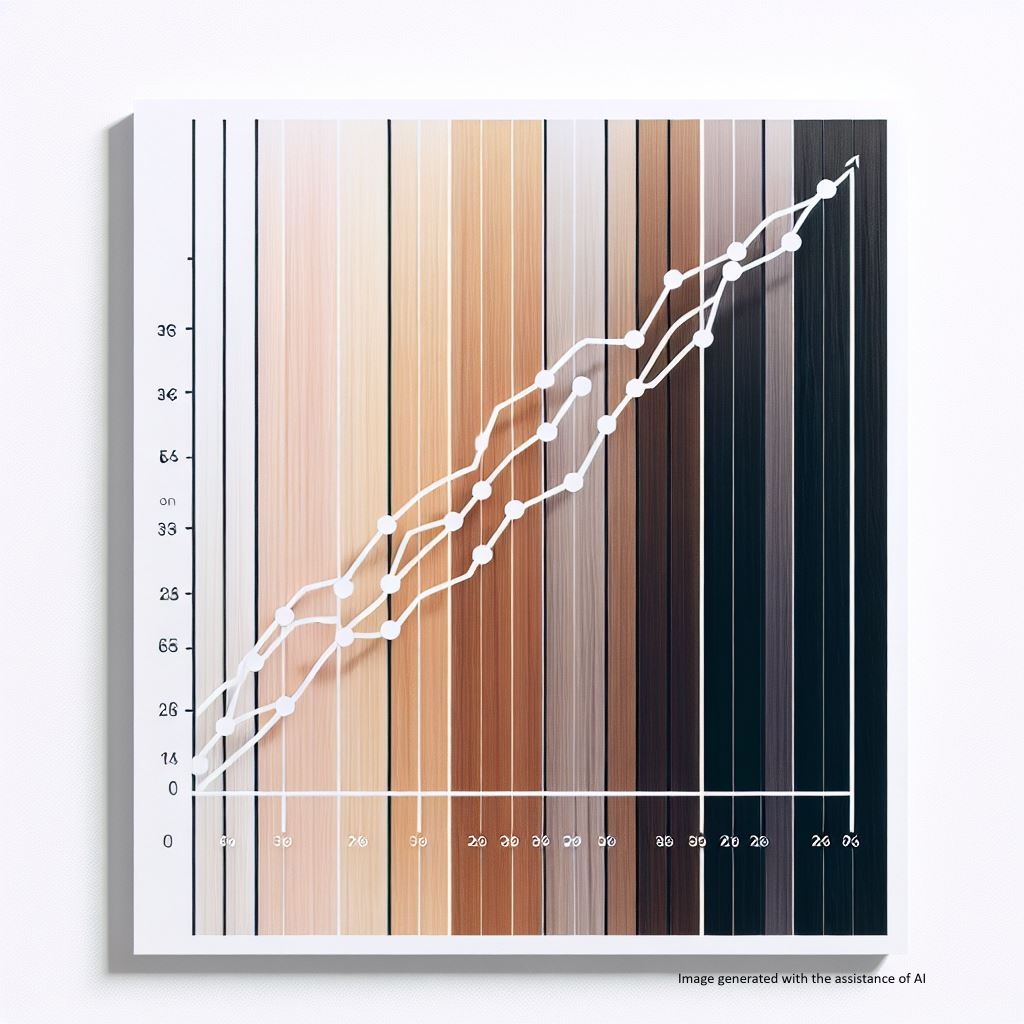

But we’re in a new century. One with its own historic economic ebbs and flows. Isn’t it about time a new indicator highlights the trajectory of American output? Enter Recession Blonde. According to this article from Vogue, a recession blonde is a darker version of a bottle blonde, which is a result of people postponing and even canceling touch-up appointments to save money. One stylist in the article does a wonderful job of reminding us that sometimes variables happen simultaneously in a completely random fashion. She believes that, “…the timing is just coincidental with more natural, rooted-looking blondes gaining popularity over the past year.” Said differently, coloration is not causation.