January 2025

The Illusion of Control

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025

Tour guides are useful when exploring unfamiliar territories. They can help make sure a trip accomplishes desired outcomes while making sure travelers avoid places where calamitous outcomes are more likely. While they cannot directly prevent spoiled vacations, they help improve the odds that one will be enjoyed.

More Positive Attitudes

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025

Growing positivity seems like a good idea most of the time for most people. While the definition of what is and isn’t positive remains subjective, most would likely agree that there ought to be more of it. According to this survey from Gallup, there was an uptick of positivity for the first

(Un)Welcomed Intrusion

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025

Greenland has been subjected to an intrusion. About a billion years ago a tectonic plate was ripped away from a second which allowed magma to flow toward the surface but be sealed by what is now the south-west portion of the autonomous territory of the Kingdom of Denmark. As the magma cooled, a giant rock developed containing 30 of the modern economy’s most desired raw materia

45^2

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025

Here we are on the first Friday of 2025. Tragically, a lot has already happened. But with so much runway ahead of us, there is much more to unfold. Of course, it will not all be a bed of roses, but we have plenty to look forward to. Before looking ahead, let’s look back. One would need to have been alive in 1936 the last time a square number was at the top of

Eggnog Blog

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025

Tis’ the season for a lot of things, eggnog being one of them. This seasonal delight faces pressure from both the supply and demand curves in 2024. The demand side is easy. More of the egg-milk punch is consumed now than in the summer, so producers expect demand to pull prices up, all else equal. This allows poultry farmers to make hay while the sun is less likely

Dancing with Data

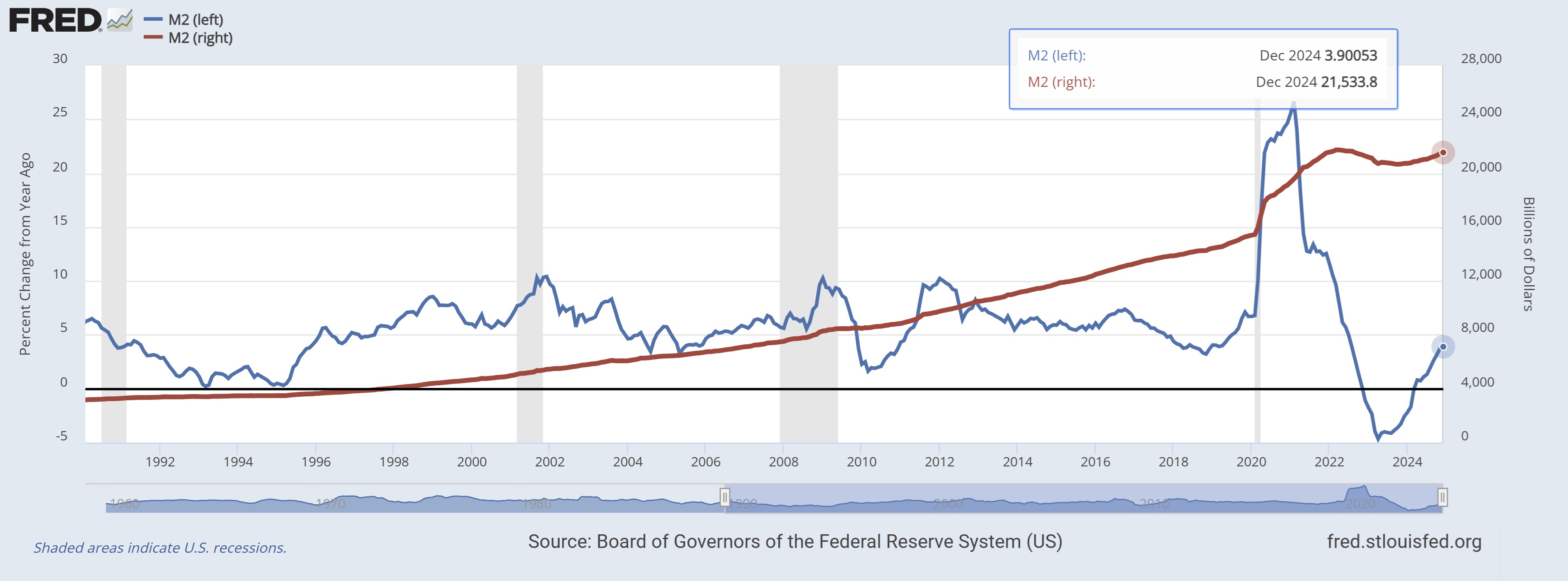

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025Imagine the Federal Reserve as a skilled dancer, gracefully navigating the dance floor of the economy. Right now, they’re performing a delicate waltz, trying to keep in step with a weakening labor market and persistent inflation that refuses to approach their two percent target.

Dancing with Data

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025Imagine the Federal Reserve as a skilled dancer, gracefully navigating the dance floor of the economy. Right now, they’re performing a delicate waltz, trying to keep in step with a weakening labor market and persistent inflation that refuses to approach their two percent target.

Small Packages

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025

It’s the holiday season. The time of year when Hershey Kisses are wrapped in green and red in addition to their traditional plain foil packaging. Years ago, they ran an add reading, “Big things come in small packages.” You can see an example here. In short, they didn’t want consumers to miss the

Foundational Shifts

Submitted by Atlas Indicators Investment Advisors on January 31st, 2025

Housing markets are ever-changing. Each month Atlas notes developments when writing about both the new and existing home sales. Many obvious changes happen (e.g., prices, transaction volume, or inventories), but other underlying currents are less obvious. The National Association of Realtors (NAR) created their 2024 Profile of Home Buyers and Sellers, and it sheds some light o