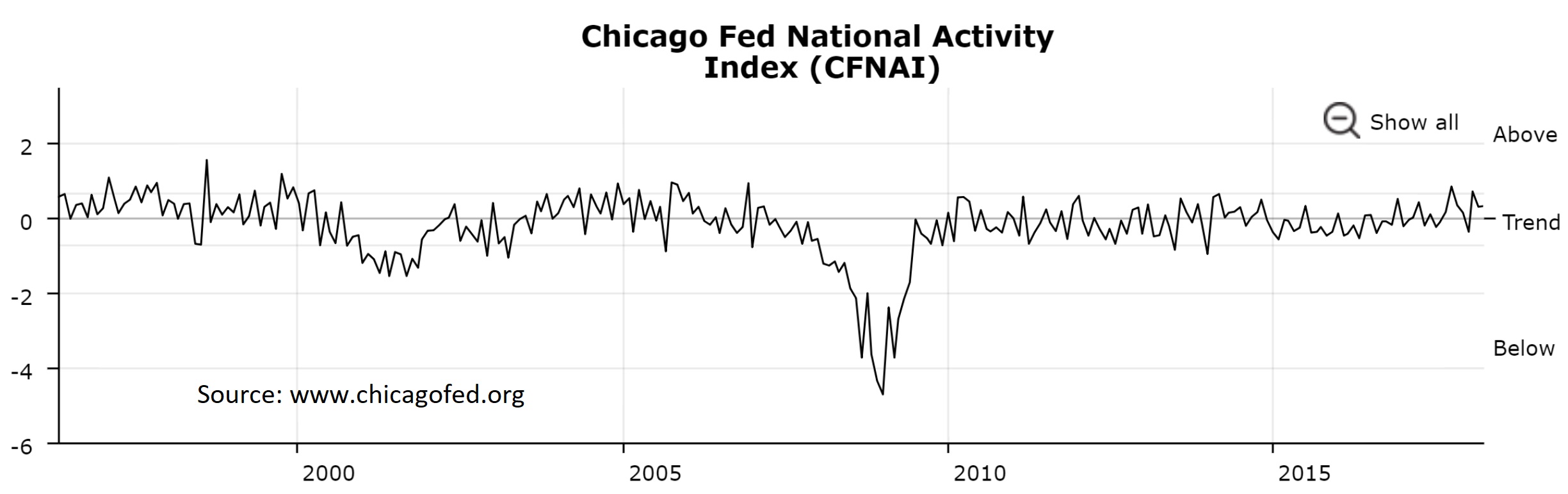

April 2018 Chicago Fed National Activity Index

Submitted by Atlas Indicators Investment Advisors on May 30th, 2018

Economic output accelerated in April 2018 according to the Chicago Fed National Activity Index (CFNAI). Their comprehensive look at the economy suggests little change in America’s growth rate as the second quarter got underway at +0.34 versus an upwardly revised +0.32 (originally +0.10) in March. While it does not point to an acceleration, the CFNAI’s three-month average is near its best level of the current expansion.

Two of the four major categories improved in the period while one of them subtracted from the total. Production related indicators tacked on +0.27 after adding +0.19 in March as industrial production rose 0.5 percent. The sales, orders, and inventories segment of the release contributed just +0.02, down slightly from +0.08. Employment related indicators contributed +0.10, accelerating from +0.04 to end the first quarter due in part to the falling unemployment rate (currently 3.9 percent). Finally, personal consumption and housing slipped to -0.05 in April after clinging to a positive count in the prior period (+0.02); falling housing permits (1.352 million annualized versus 1.377 million) contributed to the decline.

Also included in this release is a diffusion index for the CFNAI that considers how components have changed over the past three months. It edged higher, rising to +0.23 from +0.11; since February, fifty of the 85 components have made positive contributions while 35 were negative; thirty-five improved in the period as 50 deteriorated. Of the components which improved, eight still made negative contributions nonetheless.

This comprehensive indicator sheds light on the health of the American economy. There are no glaring signs of stress in this release. The upward trend appears firmly in place. As mentioned in yesterday’s Leading Economic Index note, the current expansion should continue through at least the end of this year barring something exogenous.