October 2018

Oops!

Submitted by Atlas Indicators Investment Advisors on October 21st, 2018Dodge Ball

Submitted by Atlas Indicators Investment Advisors on October 21st, 2018

It’s not that hard. You throw the ball. You hit someone.

Unless, of course, they dodge it.

September 2018 Employment Situation

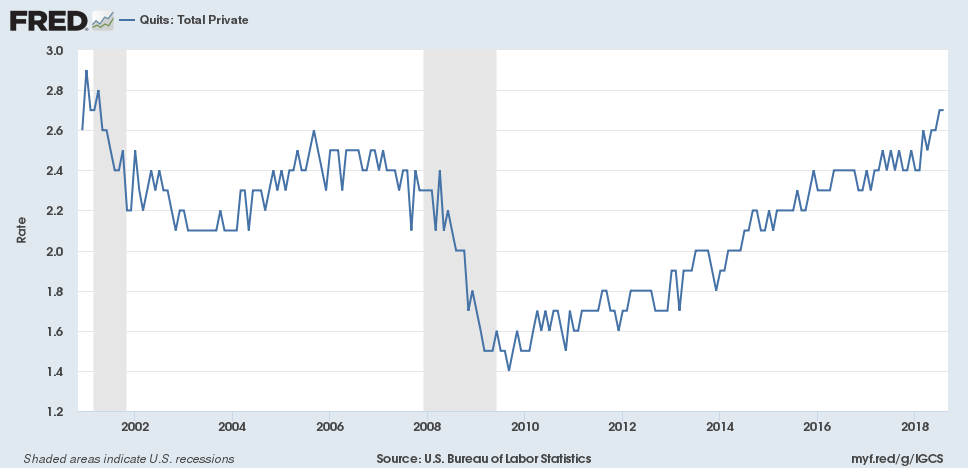

Submitted by Atlas Indicators Investment Advisors on October 21st, 2018America kept adding jobs in September 2018 according to the Bureau of Labor Statistics. Their employment situation report tallied 134,000 net new jobs in the period. Of course, this uptick is well off the average of the prior three months of over 214,000 and is the weakest gain in twelve months. However, July was revised higher by 18,000 and August received a large upward revi

Would You Like to Dance?

Submitted by Atlas Indicators Investment Advisors on October 21st, 2018August 2018 Leading Economic Index

Submitted by Atlas Indicators Investment Advisors on October 1st, 2018No economic storms can be seen from here to the horizon according to the Conference Board’s Leading Economic Index (LEI). This ten-component index theoretically looks out into the future by some six to nine months, aggregating indicators that tend to lead economic output. Its most recent iteration, released in September for August 2018, increased 0.4 percent after rising 0.7 p

Nothing New to See From Here

Submitted by Atlas Indicators Investment Advisors on October 1st, 2018

August 2018 New Home Sales

Submitted by Atlas Indicators Investment Advisors on October 1st, 2018Sales of new homes rose in August 2018 according to the Census Bureau. On an annualized basis, transactions reached 629,000 units, up 3.5 percent compared to July which was revised lower to 608,000 from 627,000. Despite a couple of week months, the level of sales is 12.7 percent higher from a year ago.

August 2018 Industrial Production

Submitted by Atlas Indicators Investment Advisors on October 1st, 2018Industrial production was strong in August 2018 according to the latest data from the Federal Reserve. Output of all physically made wares increased 0.4 percent. Perhaps more importantly, this uptick was on the heels of July’s upwardly revised tally which also grew 0.4 percent (originally 0.1 percent), and June’s increase of 0.4 percent as well.

August 2018 Retail Sales

Submitted by Atlas Indicators Investment Advisors on October 1st, 2018Retails sales decelerated in August 2018 according to data from the Census Bureau. Retail receipts grew 0.1 percent in the period after gaining 0.7 percent in July. And that’s the rub; July’s tally was upwardly revised from an already strong 0.5 percent count in the initial report. This strength gave August a tough comparison, so even though the month-over-month gr

August 2018 Consumer Price Index

Submitted by Atlas Indicators Investment Advisors on October 1st, 2018Moving Targets

Submitted by Atlas Indicators Investment Advisors on October 1st, 2018

Our central bank is charged with a dual mandate. In short, they are trying to steer the economy toward two seemingly opposing goals: full-employment and steady inflation. When trying to focus on bolstering employment, the Federal Reserve tends to keep interest rates low which encourages borrowing, thus boosting output and, ultimately, jobs. Alternatively, during periods of hig

- 1 of 2

- ››