September 2017 Personal Income and Outlays

Submitted by Atlas Indicators Investment Advisors on November 1st, 2017

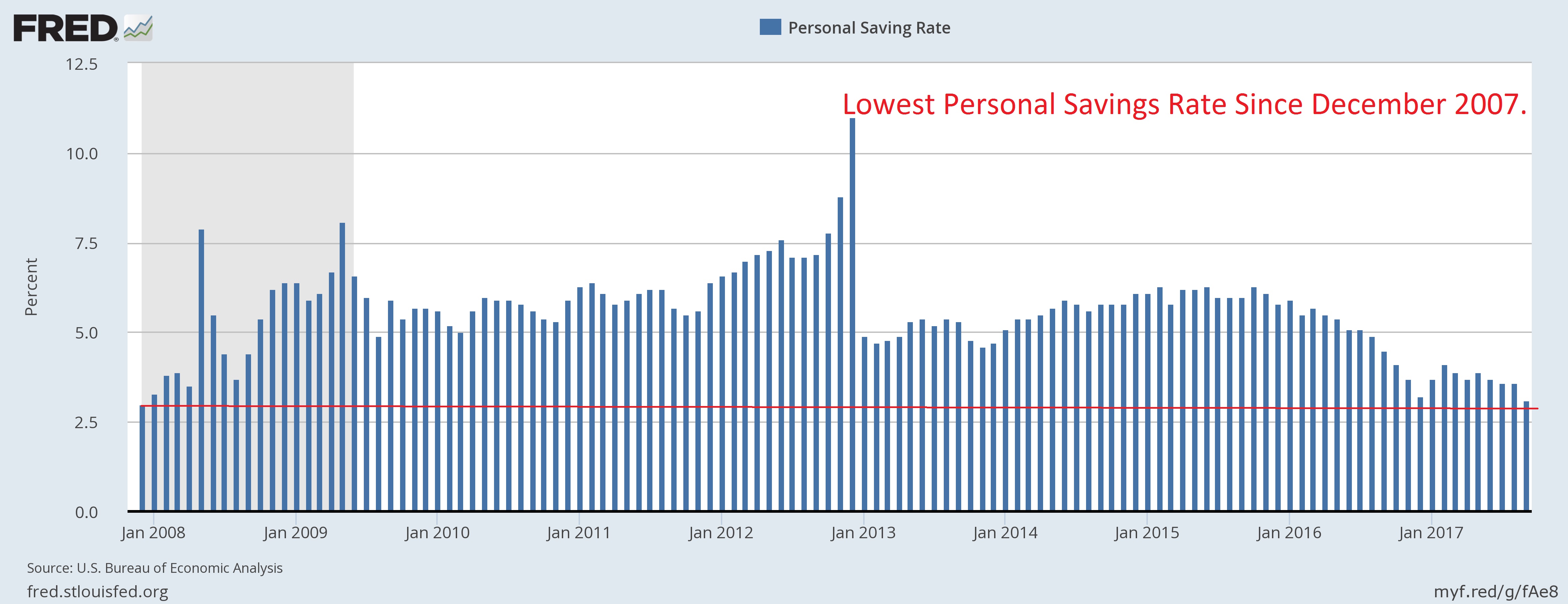

Personal income rose 0.4 percent in September 2017 according to the Bureau of Economic Analysis. This $66.9 billion uptick accelerated from August’s increase of 0.2 percent. Likewise, disposable personal income, aka after-tax pay, improved 0.4 percent. Americans used the additional take-home pay to partially fund their 1.0 percent increase in consumption. Since outlays accelerated faster than pay, the savings rate declined to just 3.1 percent, a 10-year low.

All major categories of income improved in the period. Wages and salaries (the largest segment) improved 0.4 percent. Proprietors’ income jumped 0.6 percent as did rental income. Finally, receipts on assets (dividends and interest) moved up by 0.5 percent.

Inflation data are the most interesting component of this report, core inflation more specifically. While the headline data for inflation rose 0.4 percent for the month, core inflation (removing food and energy) crept higher by just 0.1 percent. Versus a year ago, headline inflation reached 1.6 percent, and the core figure was even lower, hitting just 1.3 percent.

This lack of pricing velocity is important because the Federal Reserve has been tightening monetary policy since December 2015 and is expected to continue doing so in the near-term. However, they continue to fall short of their self-created inflation target of 2.0 percent. Time will tell if the Federal Reserve raises rates in December when they meet next (as is now widely expected), but decelerating inflation is sure to generate debate in the Eccles Building.