Revised Gross Domestic Output for the Third Quarter 2018

Submitted by Atlas Indicators Investment Advisors on December 4th, 2018

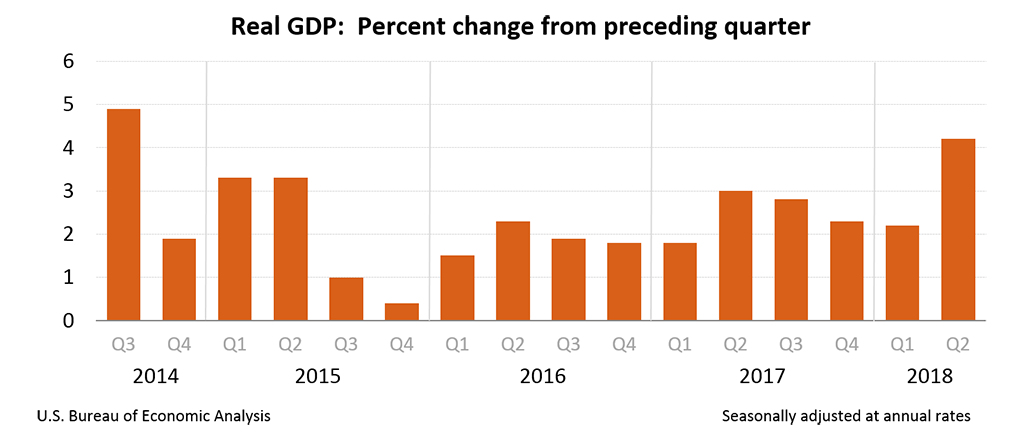

After poring over more complete data, the Bureau of Economic Analysis made a slight adjustment to their initial estimate of gross domestic product (GDP) in the second quarter of 2018. Initially reported as +4.1 percent on an annualized inflation-adjusted basis, they now believe output grew 4.2 percent. This revised tally will get one more adjustment in a final revision due out later

America’s trade deficit widened in June according to the Bureau of Economic Analysis. Increasing to $46.3 billion, this shortfall jumped 7.3 percent in the period. Year-to-date, our nation’s trading gap has widened $19.6 billion or 7.2 percent versus the same period in 2017. Both sides of the ledger worsened for the U.S.

America’s trading shortfall improved in May 2018 according to the Bureau of Economic Analysis. Our nation’s goods and services deficit dropped $3.0 billion to $43.1 billion from April’s downwardly revised tally (originally $46.2 billion). This improvement put the monthly trade gap at its narrowest reading since October 2016.

May 2018’s iteration for income and outlays from the Bureau of Economic Analysis is one of the most interesting we have seen in a while. Both components of the report improved, and consumers actually increased their savings rate, but none of that captured Atlas’ intrigue. Instead, inflation data stole the show.