August 2018 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on September 17th, 2018

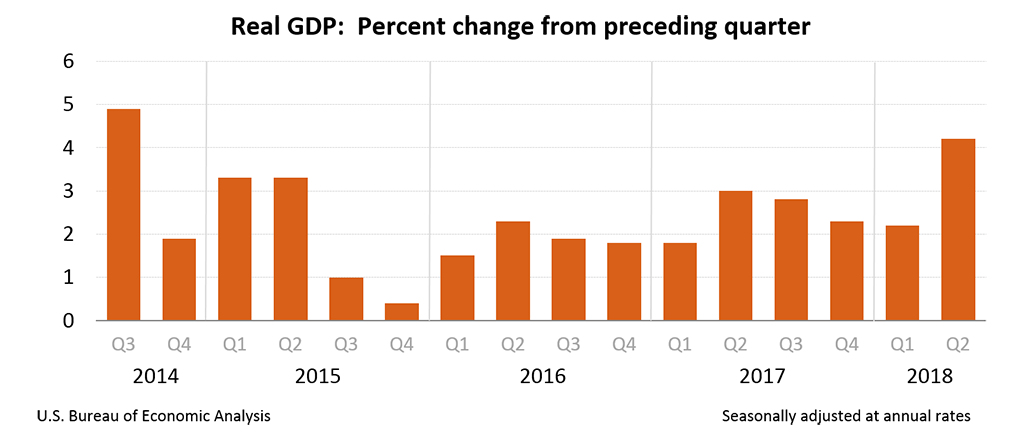

Output accelerated in August 2018 according to data from the Institute for Supply Management. Manufacturing’s reading increased to 61.3 from an already hot 58.1. Likewise, services jumped to 58.5 from 55.7. Remember, readings above 50 for these indicators are acceptable, so America’s economy appears to be moving along swimmingly.