The State of Consumer Credit Entering 2025

Submitted by Atlas Indicators Investment Advisors on February 26th, 2025

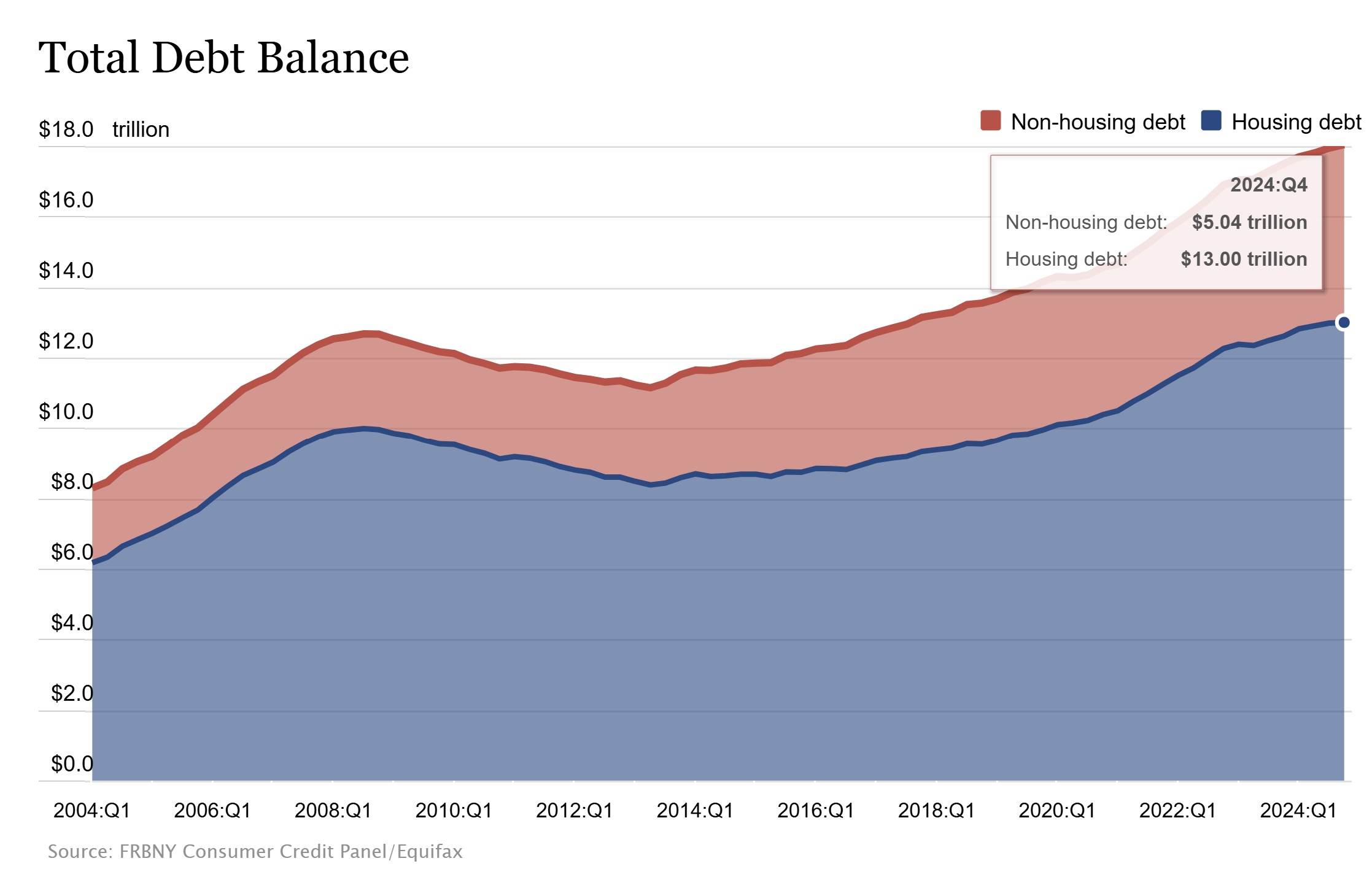

American households are navigating a complex credit landscape in early 2025 according to releases from the New York Federal Reserve. Total household debt hit a record $18.04 trillion at the end of 2024, driven largely by credit card balances, which surged to $1.21 trillion. While many consumers continue to manage their debt responsibly (especially with mortgages, where delinquency rates remain stable), there are clear pressure points.

Credit card delinquency rates rose slightly, with 7.18 percent of balances now 90+ days overdue, up from 6.36 percent in late 2023. Auto loans are another area of concern: serious delinquencies (90+ days late) increased to 2.96 percent, reflecting the strain of higher car prices and interest rates on households. These trends suggest that while the broader economy remains resilient, certain groups (especially lower-income borrowers and those with subprime credit) are feeling the squeeze of persistent inflation and tighter lending standards.

Changes in the auto market influence this divide further. Used car prices, which spiked during the pandemic, have declined recently, leaving some borrowers underwater on loans taken out when prices were higher. This has contributed to rising defaults, particularly among younger buyers. This is influencing lending policies. For example, 15 percent of Millennials surveyed in late 2024 said they were "very likely" to buy a car in early 2025, the highest of any generation; but for those facing financial headwinds, lenders are responding cautiously. Banks and credit unions reduced auto lending in late 2024 as charge-off rates (loans deemed uncollectible) hit 1.2 percent, nearly double the long-term average.

Our nation and its residents love debt. This affinity helps push the pace of economic growth, but the credit market also has a cycle like that of the overall economy, ebbing and flowing over time. This release hardly indicates the virtuous portion of the current cycle is ending, but it does offer insight into areas which are growing less perfect.