October 2019 National Federation of Independent Business

Submitted by Atlas Indicators Investment Advisors on November 20th, 2019

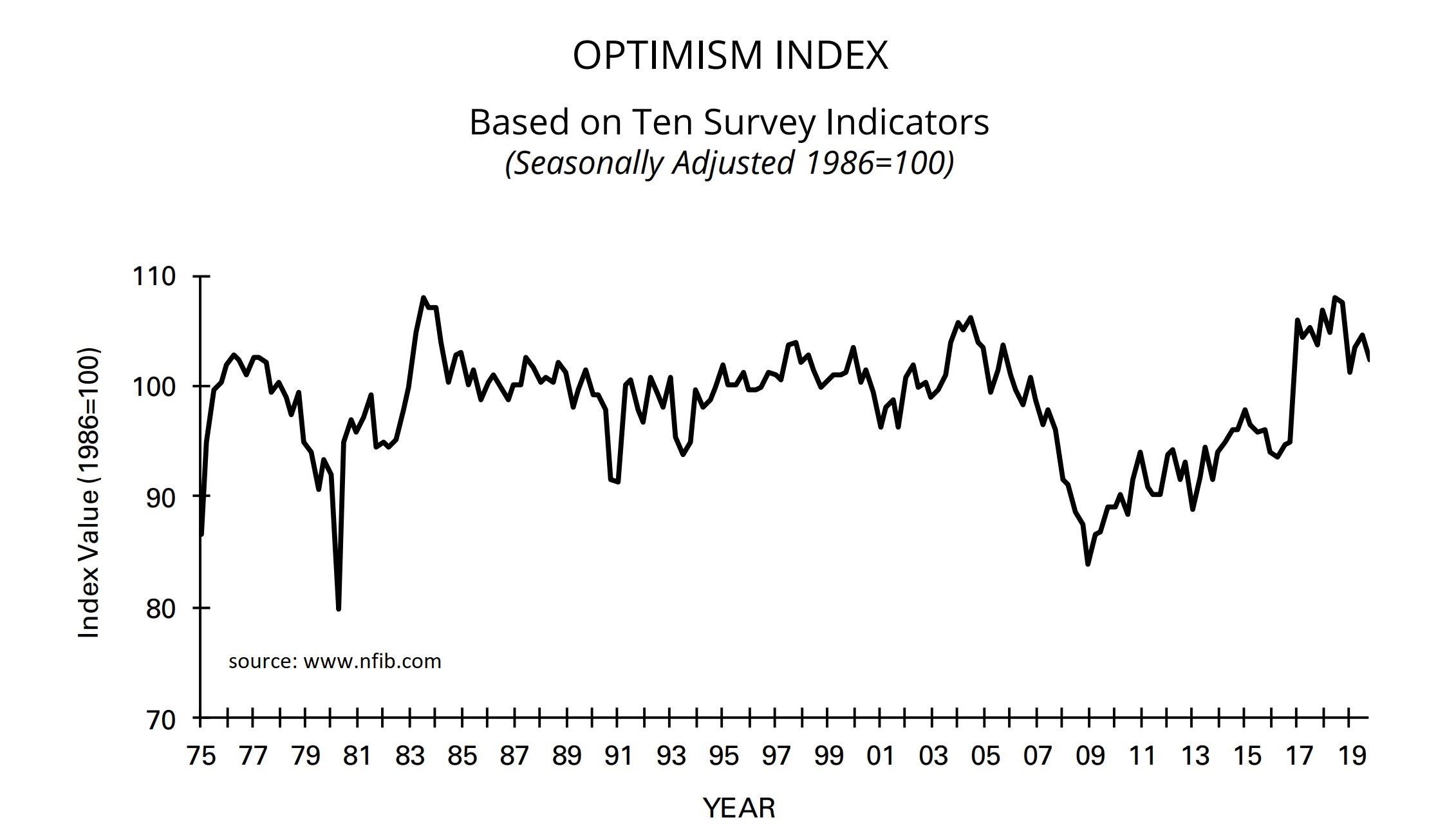

Small business optimism remains high by historical standards according to the latest data from the National Federation of Independent Business. Their small business index rose to 102.4, an uptick of 0.6 point. This increase was fairly pervasive as eight of the ten components rose.

To get it out of the way, let’s start with the bad news. Fewer firms expressed having a rising earnings trend. Additionally, current job openings dipped marginally in the period. Not that bad, right?

Now on to the good news. Plans for capital spending, inventory investment, and job creation all increased; these are forward-looking since they describe actions which have yet to take place, boding well for the economy in the future. Expectations for the economy to improve as well as anticipated sales rose which might help explain why actual capital investment increased in the period; this should support gross domestic product growth in the final quarter of this year. Fewer believe their current inventory levels are adequate to support future demand as well. Finally, credit expectations are rising, suggesting firms believe borrowing conditions will improve for those taking on debt to increase output.

This indicator remains high. However, we must acknowledge that it has been trending lower since peaking in the summer of 2017 (see the chart above). But make no mistake, Main Street America is optimistic. J R and I noticed the busy rail system a few weeks ago as we headed east on I-40. This indicator parallels our anecdotal experience with actual survey data.