November 2019 Retail Sales

Submitted by Atlas Indicators Investment Advisors on January 5th, 2020

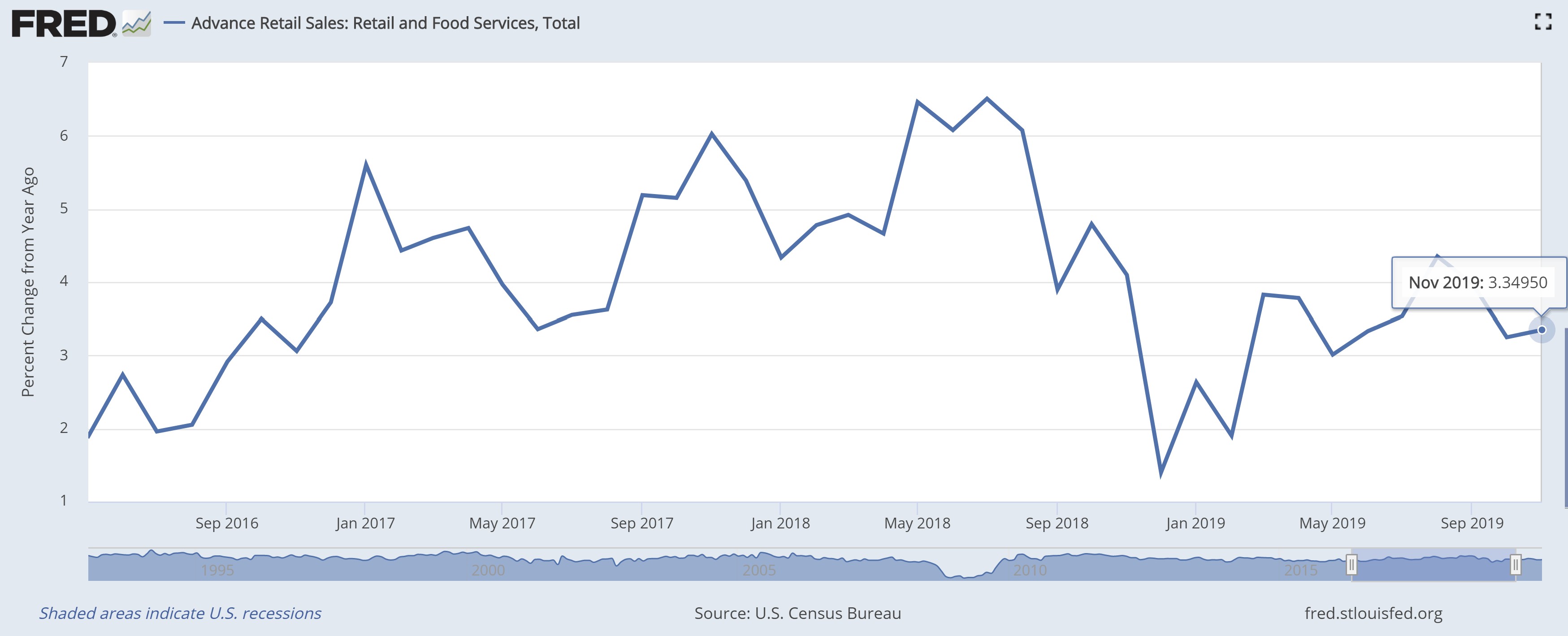

Retail sales improved in November 2019 according to the Census Bureau. This 0.2 percent gain to $528.0 billion is on the heels of October’s upwardly revised uptick of 0.4 percent. Versus a year ago, sales are up $17.1 billion or 3.3 percent. There was plenty of good news in the release, but as you’ll see later, one dark lining to this silver cloud.

Several categories experienced growth. Sales of vehicles and auto parts gained 0.5 percent in the period. Receipts at electronics and appliance store rose 0.7 percent, matching the gain at gas stations. Even general merchandise firms managed a 0.1 percent uptick. Finally, the category which has benefited greatly from shoppers’ shifting preferences, nonstore retailers, gained 0.8 percent and have jumped 11.5 percent in the past year. However, it wasn’t all good news.

Atlas’ favorite line item in this report, food services and drinking places, was lower for a second consecutive month. This critical figure dipped 0.3 percent. This will be watched closely in the months ahead. We want to know if a weakening trend is developing in this segment of spending. It represents the most discretionary portion of a household’s budget since it is easily substituted with a cheaper alternative at home. Atlas views this as proxy for confidence, and Americans are behaving like it is waning lately.

Despite the above-mentioned setback, the sky is hardly falling. The year-over-year trend for retail sales and its food service and drinking places subset are positive. America’s economy has an upward sloping trajectory, so the probability remains high that that this trend will continue.