Not Quite a Golden Egg

Submitted by Atlas Indicators Investment Advisors on May 3rd, 2018

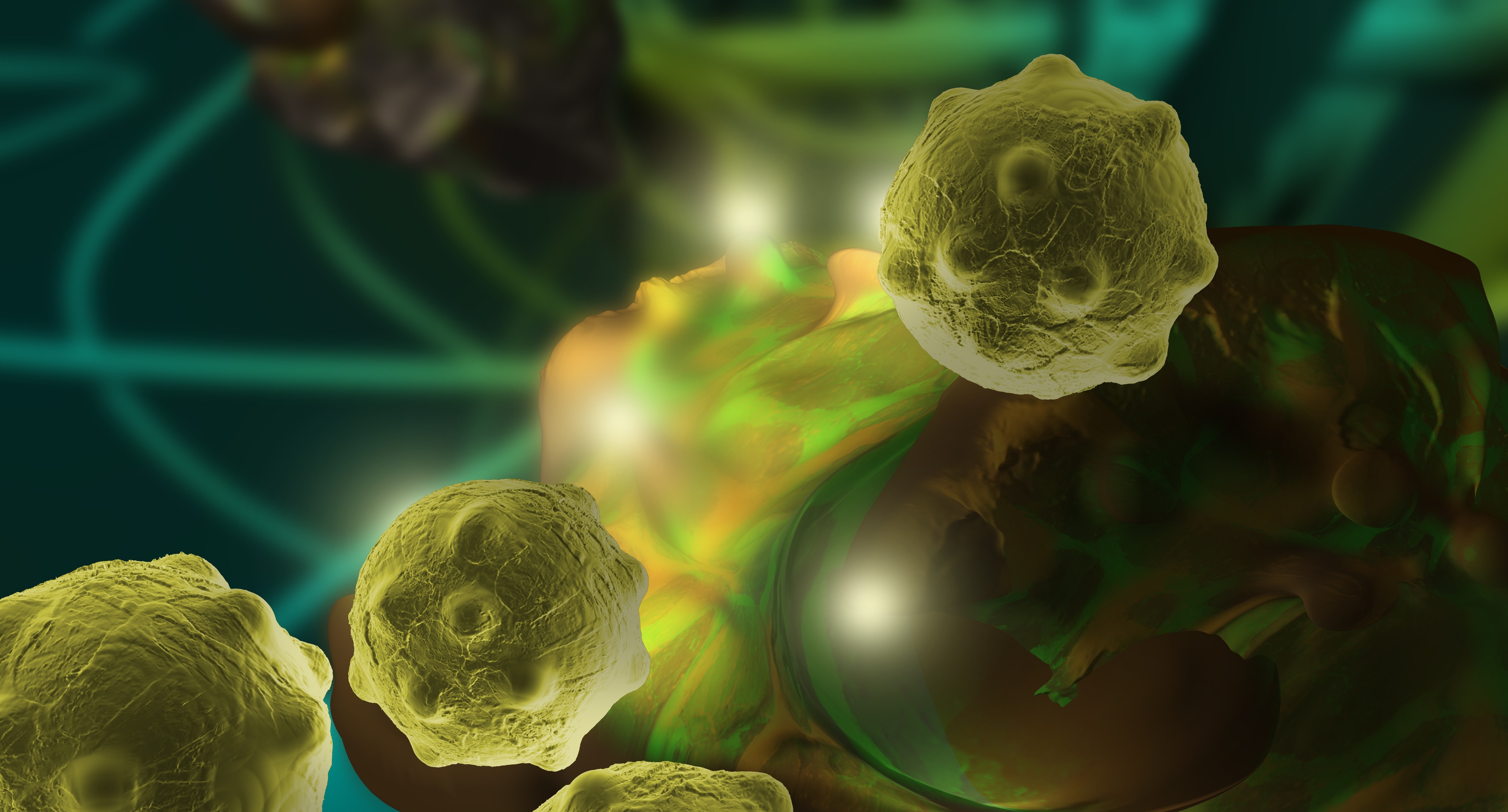

Bacteria are everywhere. As one of the first lifeforms here on earth, they have had billions of years to reproduce. Scientists believe the bacteria biomass is greater than all plants and animals combined. Helping their accumulation efforts, they have developed an ability to exist in even the most inhospitable environments. Nonetheless, these little things are disdained by many, often painted with a broad brush as bad, but the vast majority of them are helpful to humans so put down your antibacterial hand sanitizer.

There is no telling what you might kill with that convenient cleaner. For instance, you could possibly take out a Cupriavidus metallidurans. That said, any central bank might appreciate your effort to eliminate the competition. You see, you’d be killing the bacteria that poops golden nuggets. Actually, finding yourself in this situation could be bad for your health.

C. metallidurans thrive in areas in which other organisms cannot. Their preferred habitats are soils with both hydrogen and toxic heavy metals; this is generally too poisonous for other life forms to exist. Essentially, these bacteria ingest virulent gold compounds, detoxify this version of the element via a quasi-digestion, and excrete the metallic form. Not quite an egg, but you get the idea.

Long considered a storehouse of value, nations hoard gold during periods of heightened uncertainty, but its assumed role as a currency surrogate could be damaged if too much supply gets egested by little critters working on the cheap. Scientists are studying this ability of C. metallidurans (and at least two other types of bacteria), hoping to use them to recover the precious metal. If they can replicate or scale the mining process, it could be seriously disruptive to markets.

Before you pawn your valuables, nobody in a lab coat is yelling eureka just yet. Governments and central banks are probably not losing much sleep either. This is a rare bacteria, so the amount of gold produced is unlikely to upset the current balance of power in the immediate future.