Cooking with AI

Submitted by Atlas Indicators Investment Advisors on June 30th, 2025

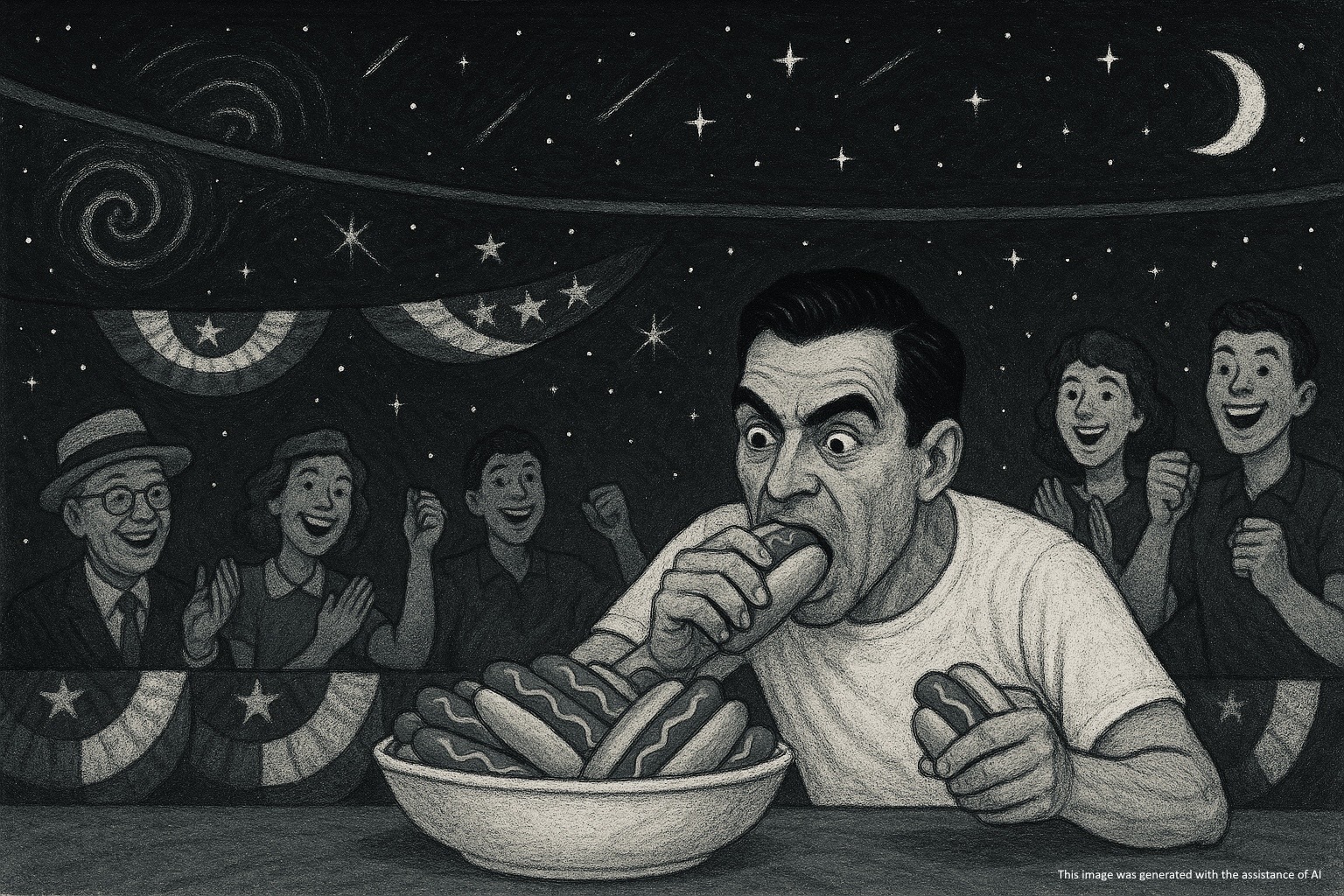

The Fourth of July is right around the corner, commemorating the birth of America with fireworks, Atlas looks forward to Nathan’s Famous Hot Dog-Eating Championship and the Twilight Zone Marathon. Joey Chestnut will be competing this year after a sponsorship-related ban in 2024. We’ve also just discovered that the Heroes & Icons Network (not sure if our house gets that channel) will carry Rod Serling’s black and white classic.

One particular episode, “To Serve Man,” came to mind recently. In it, earth is visited by Kanamits, a race of nine-foot-tall aliens during a period of international crisis. In short, these visitors are here to help, offering solutions to energy and food shortages which would, in turn, help solve conflicts among nations. Early in the narrative, a book is left behind at the United Nations with the same title as the episode: To Serve Man.

Not much is made of the book at first. The visitors were able help in immense ways with deserts turning into fertile farmland, energy becoming abundant, and militaries obsolete. However, later in the episode, a cryptographer is able to decode the book and figure out that it is not about improving the human conditions on earth but is, instead, a cookbook with humans as a main dish. The aliens helpful introduction allowed humans to put their guard down.

There may be parallels between this allegory and Artificial Intelligence (AI). It has started out being quite helpful to those sharp enough to harness its capabilities. The technology is quickly reshaping industries, education, and probably the distribution of wealth. But there could be some downside. For instance, the folks at Goldman Sachs expect 50 percent job automation by 2045, while a study by the McKenzie Global Institute suggests 14 percent of the global workforce may need to switch occupational categories by 2030 (that’s 375 million people in just 5 years). Like the alien’s book, AI is written in codes which most people won’t ever understand, making it harder to prepare for its long-term trajectory. So far, the relatively nascent technology is proving helpful, but there are concerns about its future, causing entities like the World Health Organization to contemplate the development of guardrails to help ensure it doesn’t cannibalize a large portion of the globe’s worker force. Just as Kanamit’s intentions were hidden in plain sight, masked by short-term solutions, the true trajectory of AI must not prove to be obscured by its initial convenience.