What’s on the Hor “AI” zon?

Submitted by Atlas Indicators Investment Advisors on August 31st, 2025

Steam engines and factories transformed the modern way of life during the Industrial Revolution. It rendered many technologies and skills obsolete while opening up an entirely new set of opportunities for those willing to transition away from a cottage industry into the more scalable competition that mechanization created. Today, the economy could be in the middle of a similar transformation by way of Artificial Intelligence (AI). Like machines of the late 18th through the 19th century that outpaced human strength, AI is now outthinking and outperforming in some tasks performed by specially educated and trained workers in our modern society. It’s tough to imagine a person in 1790 being able to forecast what was ahead, much like it probably is difficult to fully grasp tomorrow from our current vantage point.

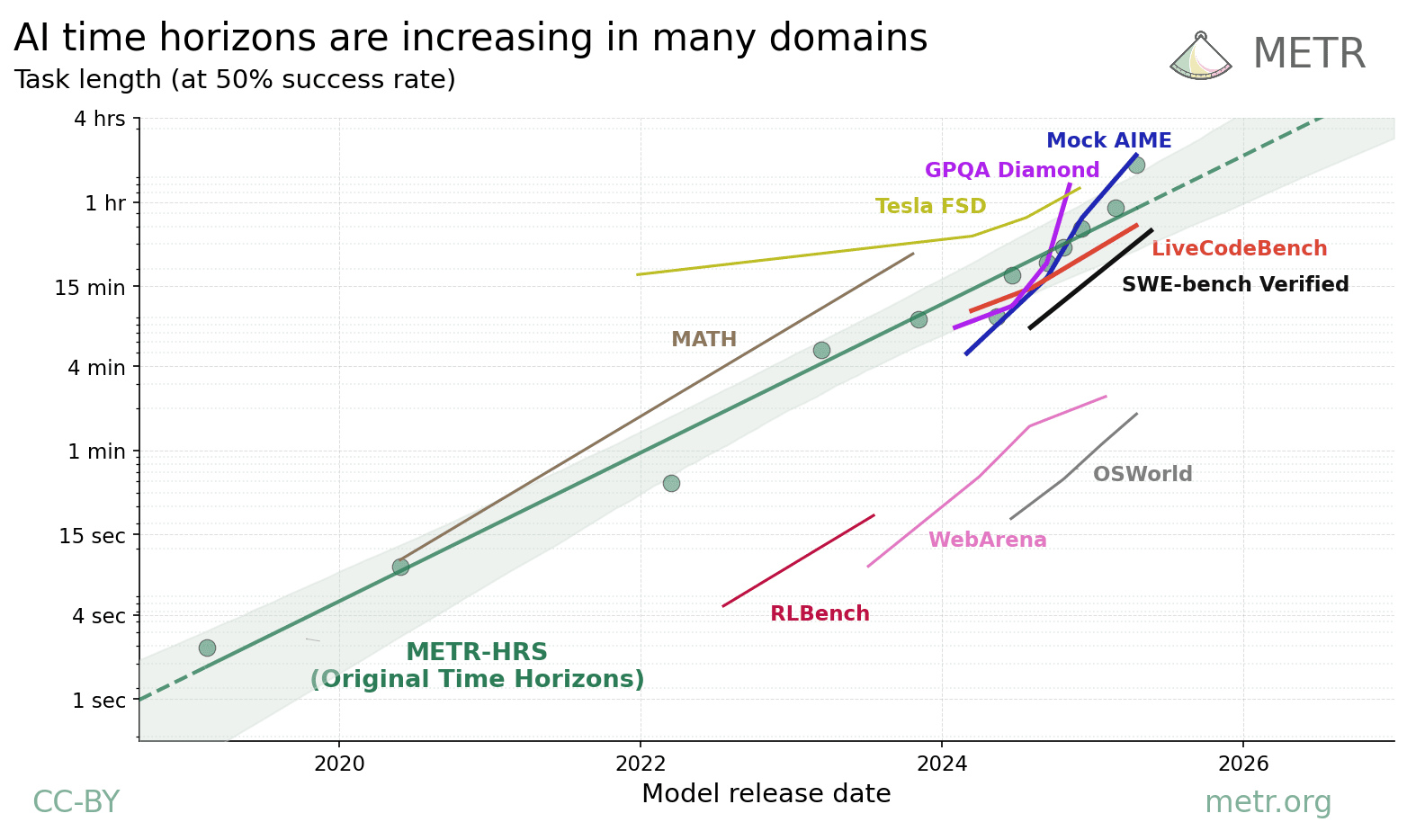

While we cannot see into the future, some are spending time considering possible outcomes, updating their forecasts as AI evolves. One group called METR, located in West Covina, California, evaluates the most cutting-edge AI models (aka frontier AI systems), testing their abilities to complete tasks without human input. This means they are working with AI agents (AI systems with access to tools which are set up to work continuously).

These AI agents are always pushing against limitations of previous experience. As they learn, however, they become more capable and new models are being programmed all the time. One development METR has observed is that the length of task an AI agent can complete doubles almost every four to seven months. As recently as 2020, agents were only able to complete tasks that took humans under 15 seconds to complete (i.e., not very difficult programming). Now, they quickly complete software engineering and research tasks that take humans about an hour to finish.

What lies beyond the current horizon for AI is unknowable. Just as steam power redefined industry, AI agents may soon redefine what it means to work, create, and innovate. In fact, METR suggests the growth could have these agents rapidly completing tasks that take humans weeks and even months by the end of this decade. If history is any guide, those who adapt early will find themselves shaping the future rather than reacting to it.