Rising Water

Submitted by Atlas Indicators Investment Advisors on October 3rd, 2024

Hurricane Helene is the latest deadly hurricane to hit the US. It is still relatively early, but the costs are soaring. So far it has taken over 160 lives. In addition to the death toll, it will cost billions of dollars to repair cities like Asheville, NC to their prior glory. So much of this damage was caused by water, a lot of water.

Meteorologists estimate that over 40 trillion gallons of water fell from the sky during this meteorological even. Anything measured in trillions makes me think of metaphors to help quantify such large numbers. According to this article from PBS, that is roughly the amount of water in Lake Tahoe (a body of water covering 191 square miles with an average depth of 1000 feet) or enough water to fill the Dallas Cowboy’s stadium 51,000 times. Folks in that part of the nation are facing an acute crisis and have a difficult recovery ahead of them.

Or consider time itself. It takes just over 11.5 days for one million seconds to pass. One billion seconds pass roughly every 32 years, and it therefore takes almost 32,000 years for one trillion seconds to be counted. A trillion is large.

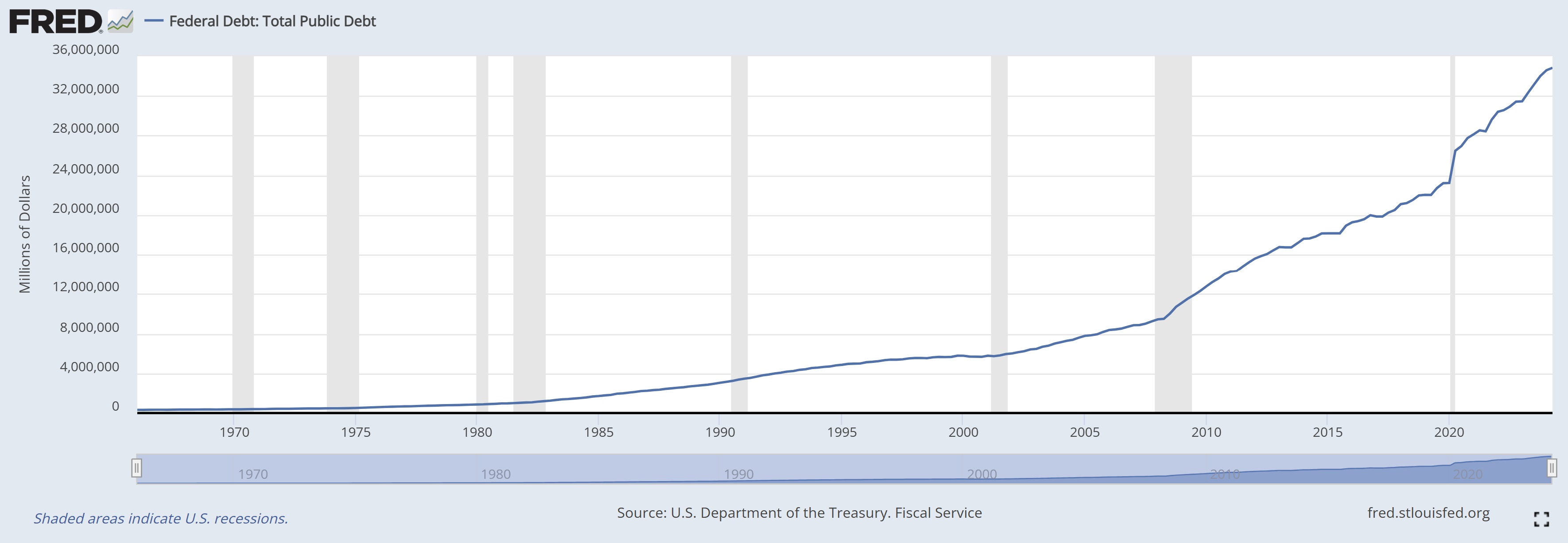

As of this writing, America had nearly $35.4 trillion in debt according to the fast counter on usdebtclock.org. Around this time in 1980, the nation’s debt level reached $1 trillion for the first time and hasn’t looked back since. Now the interest costs alone are about that much. At the current rate, the nation will hit $40 trillion in debt in roughly two years or so.

Folks devastated by the hurricane need help, and the nation’s leaders seem willing to provide it. While extending support to those affected is an act of compassion, it seems reasonable to also be mindful of our fiscal responsibilities. Balancing immediate needs with long-term financial stability may prove crucial in the years ahead. America will be well-served navigating the delicate balance of helping rebuild these devastated communities while also trying to safeguard its economic future.