Riff, Rift, and Drift

Submitted by Atlas Indicators Investment Advisors on November 3rd, 2023

Breakup songs that make their way into pop culture have a way of staying relevant by transcending time and touching the hearts of generations. Who can listen to Etta James sing “I’d Rather Go Blind” and not feel the pain of losing the one you love? Who can resist singing along with the Righteous Brothers when they lament “You Lost That Lovin’ Feelin’” in their 1964 classic? Breakups are hard, and sometimes music is the best way to cope.

Breakups don’t have to be so emotional, though. For instance, our economy is witnessing a separation of sorts, and few, if any, are talking about it, let alone shedding tears. For years, there was a relatively tight relationship between the 10-year Treasury rate and the average conventional 30-year fixed rate mortgage. Lenders may use the 10-year Treasury yield as a reference point for setting their own interest rates, including those for conventional 30-year, fixed-rate mortgages. A rising Treasury yield often leads to increasing mortgage rates. Of course, the mortgage rate will typically be higher than the Treasury yield to account for the greater risk and administrative costs associated with home loans.

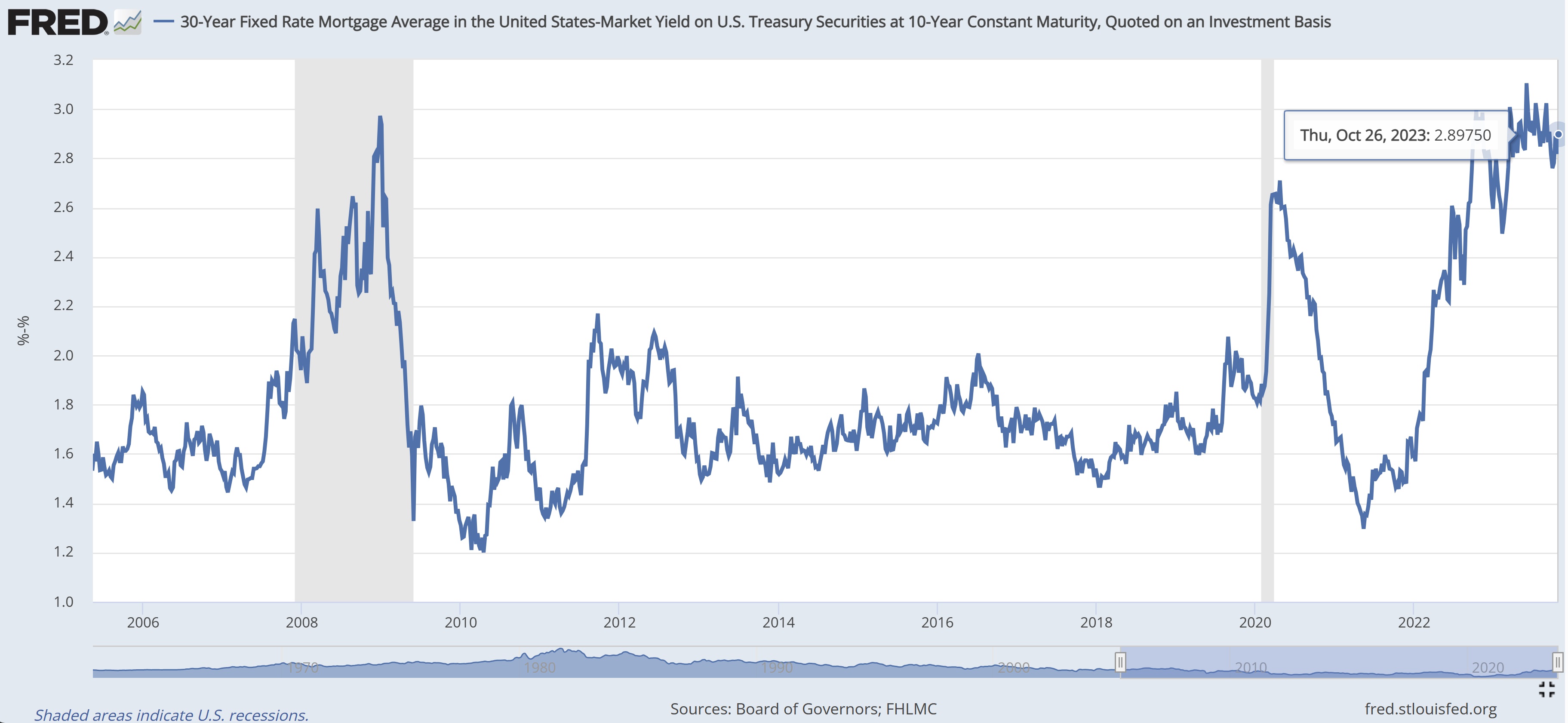

Using data from the Federal Reserve Bank of St. Louis and Freddie Mac, Atlas found the average difference between the two rates was 1.75 percent from August 2005 through March of last year. There were 887 weeks during that period and August was used because that was the earliest date the Fed’s regional bank made available. Since March of last year, some distance has grown between the two partners. Starting with data from the day after the first post-covid rate hike until yesterday, the difference has averaged 2.69 percent, an increase of 53.7 percent. Any number of variables could be at play for the larger than was previously normal spread, including risk aversion from lenders.

Every week, Atlas keeps an eye on the mortgage market by checking the data published by Freddie Mac. Of course, there is another Mac that also knows a thing or two about breaking up. We’re talking about Fleetwood Mac, the legendary rock band that went through a tumultuous split in the 1970s. Their song “Go Your Own Way” was a hit single from their album Rumours. It was written by Lindsey Buckingham as a way of expressing his frustration with his ex-girlfriend and bandmate Stevie Nicks. He felt that she was not giving him the love and loyalty he deserved, and he wanted to let her go. Similarly, the two interest rates that we track have been drifting apart lately, showing a larger gap between them. They may still be linked in some ways, but for now they are going their own ways.