Retired Retirement Repository

Submitted by Atlas Indicators Investment Advisors on January 4th, 2018

Retirement goals are often met with a little help from friends, specifically those from subsequent generations. Pensions are perfect examples. As one works and contributes to defined contribution plans (think Social Security), the design of the scheme is rarely self-financed. Outcomes tend to be best if the next generation is larger and wealthier than the one before it. For instance, if generation A contributes 10 percent of their income and collects 10 percent of generation B’s pay (which is presumed to be a larger and wealthier cohort), the pyramid’s foundation is healthy. Unfortunately, Social Security’s foundation shows signs of weakness.

Information contained in the 2017 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Fund revealed possible cracks in the foundation. Since 2010, less money has been contributed to Social Security than has been paid out. However, since the funds in the trust have been borrowed by the government, interest payments make up more than the difference, leading to a total income which exceeds total costs, something that has occurred every year since 1982 and is projected to happen for another four years (the end of 2021). From 2022 forward, Social Security’s total income will run at a deficit to outlays, requiring the fund to spend principal.

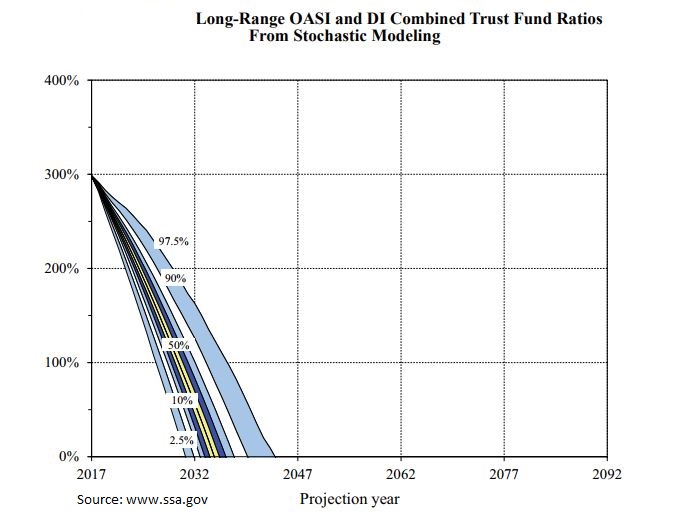

Forecasting is tricky even when variables are limited, and unknowable factors in a dynamic economy like America’s are virtually infinite. In order to minimize the sense of certitude in their projections, the trustees created sophisticated statistical models to help understand the possible range of outcomes. In summary, this approach suggests a 95 percent probability of trust fund depletion between 2030 and 2043. In 2018, neither of those years feels very far from now.

Sometime in the not too distant future, our country will need to participate in a serious discussion regarding the purpose and funding of Social Security. Opinions on the matter are already diverse. Some argue it was never meant to aggregate as a trust fund but that it is simply a transfer from working people to retirees. Currency technologies outside of the mainstream could play into this debate as well. Today, it is not difficult to imagine an underground payment system being used to circumvent the conveyance of income. Then who is going to pay for retirees’ basic needs?