Permanent Olympics

Submitted by Atlas Indicators Investment Advisors on February 29th, 2024

Imagine if managing money was a sport, where businesses, households, and nonprofits are diligently practicing their financial gymnastics, trying to stick the perfect landing on the budget mat. They leap through hoops of income and expenses, striving not to face-plant into the pit of insolvency or scare away the delicate gazelles known as donors. Households pirouette on the thin beam of balance, hoping not to fall off and into the arms of unimpressed bank lenders, thus forfeiting their shot at the coveted American Dream trophy.

Now, picture America's Federal Government stepping up to compete. They've got their own special event: the Budget Balancing Act, so it isn’t exactly a fair competition. And there is a kicker to boot: when their revenues don't quite stick the landing, they don’t just wobble and regain their footing; they pull out a giant credit card and start borrowing more.

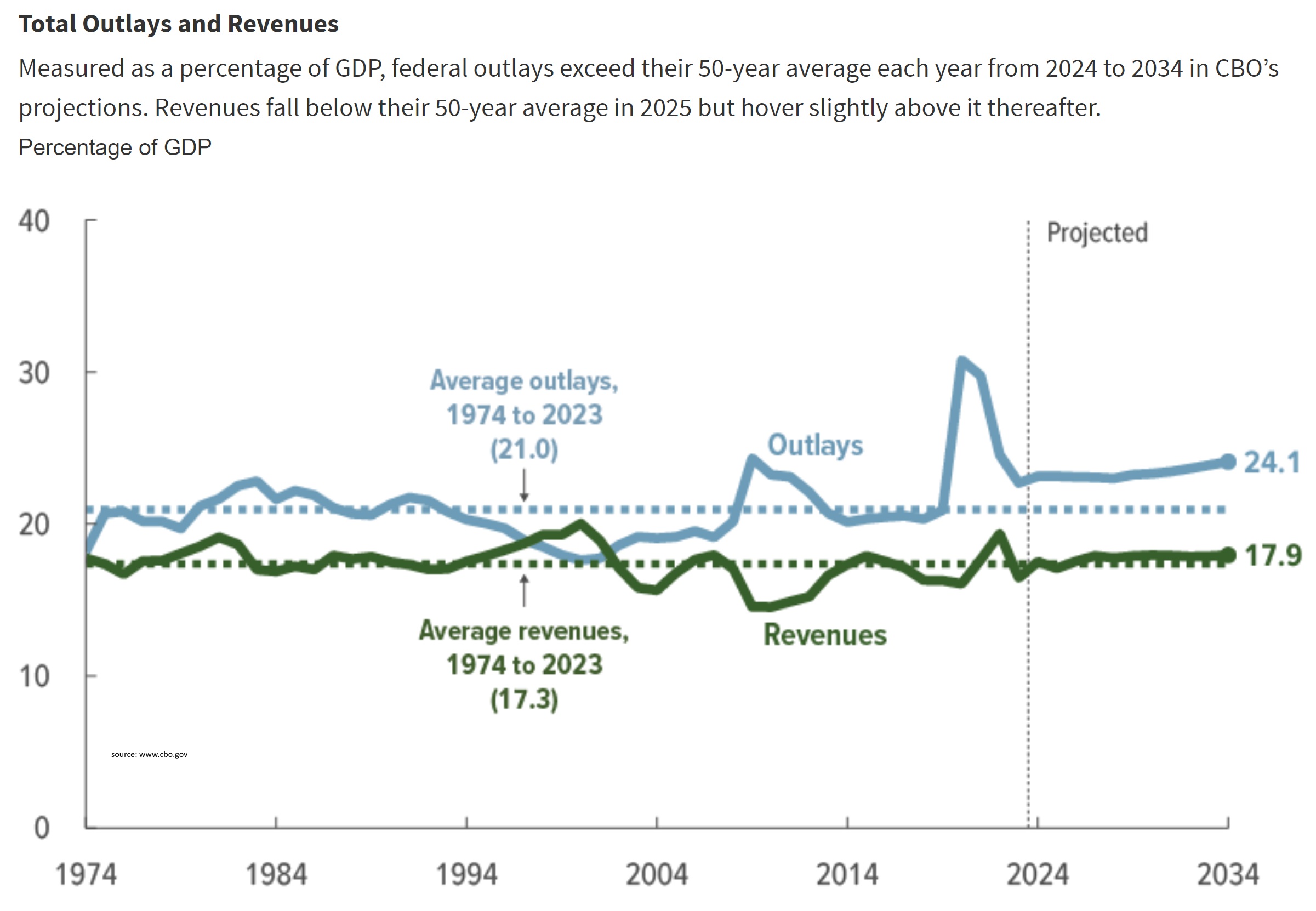

The latest from the Congressional Budget Office (CBO) is like the play-by-play commentary at this financial Olympics. They've just announced that the U.S. is set to borrow an additional $1.6 trillion this fiscal year (alone!); this would amount to 5.6 percent of fiscal 2024’s estimated gross domestic product (GDP). Doing this while keeping interest rates low earns a difficulty level we haven't seen in decades. To put it in perspective, the deficit's been around 3.7 percent on average for the last 50 years, but now they have decided to go for gold by jumping it up to 6.1% by 2034.

But wait, there's more. This debt isn't just for an Olympic season; it's going on the U.S.'s permanent record. By 2034, the debt-to-GDP ratio is expected to hit a historic 116 percent, and then, like an overambitious gymnast attempting a quadruple backflip, it's projected to soar to a jaw-dropping 172 percent in another 30 years. The CBO points to mandatory spending on social programs and interest costs puffing up like an exercise ball, far outpacing any attempts to trim down spending or boost revenues.

America is in the midst of financial acrobatics like never before, folks. The pandemic had the government and the Federal Reserve teaming up for a spectacular synchronized swimming routine, throwing money into the economy like javelins. The long-term effects? Well, they're as clear as mud. Debates are raging hotter than a gymnast's unchalked hands about whether this debt will hamstring the country's economic output or if, in this grand fiscal competition, the usual rules just don't apply to a heavyweight like our government.

So, as we tune in to watch this ongoing spectacle, it's worth pondering: can the U.S. stick the landing, or will it need to invent a whole new scoring system to keep its financial hopes alive? Only time will tell, but for now, the financial gymnastics competition is an event for which tuning in is definitely worth it.