LogicHole

Submitted by Atlas Indicators Investment Advisors on October 28th, 2021

Holes can crop up anywhere. There’s always one on a perfectly quaffed putting green. Although I’ve never see it, there is supposed to be a big one in the middle of the Milky Way Galaxy. Analysts on Saturday and Sunday afternoons might comment on one which opens up when a blocking scheme is particularly effective during football season. And every once in a while, one will appear in logic (it’s usually not a good sign).

Now none of us are central bankers, so maybe this is out of line, but it’s starting to feel like the Federal Reserve’s argument that inflation is transitory is getting old. Not only are prices moving up, but things that drive inflation (wages come to mind) are under upward pressure.

I was chatting with a client recently about one of their recent challenges as a business owner: filling a job. As it turns out, they had a position open that required some skill (those needed to be a delivery driver), but this is not what one would consider such a unique skillset that there wouldn’t be available candidates. Well, at least that’s what I thought. As it turns out, in order fill the position, the wage had to go up 22.2 percent from where it was at the start of this year before a person would fill the role. Anecdotes, even a few of them, are not the same as data, so Atlas did some digging.

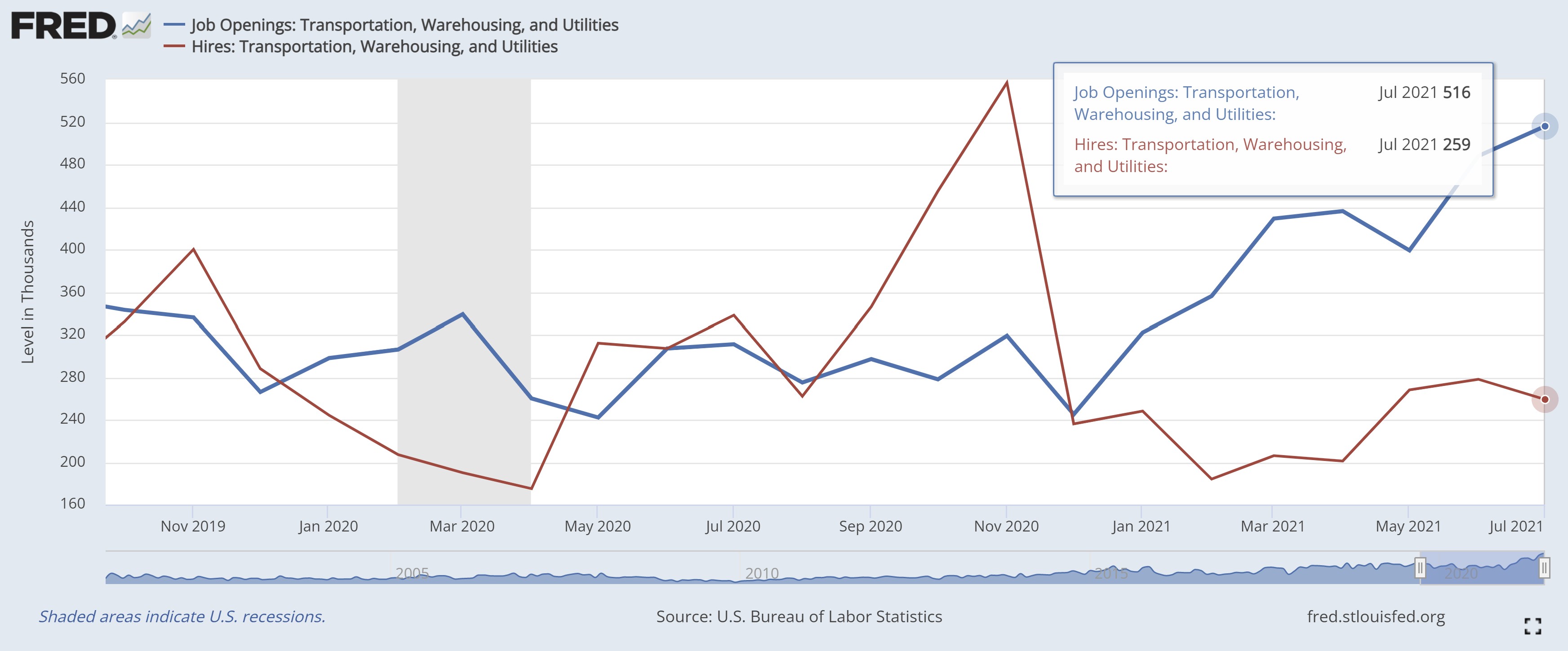

This shortage seems to be much more pervasive than just a local challenge. According to the latest Job Opening and Labor Turnover (JOLTS) report from the Bureau of Labor Statistics, the chasm between supply and demand in the transportation, warehousing, and utilities segment is widening. Hires in this category declined on both a monthly and year-over-year measure. Conversely, job openings here increased over the same periods.

After years of disinflation, our economy might be headed for accelerating inflation. Labor is a major input to the cost of producing goods and services. In order for goods (made here in America or not) to arrive at stores or the end user’s doorstep, these items need to be made, stored, and then shipped. It’s not yet clear how this challenge will be solved, but the growing cargo ship backup at our nation’s ports don’t suggest the solution has been found. And if wage increases are the answer, we must also live with the likelihood that compensation levels are sticky (i.e., it is hard to take back a raise and not upset an employee). The employment hole is growing, as illustrated in the graph above, just one of several challenges facing America as we move away from the temporary shutdown of last year. A hole in central bankers’ logic might be another one.