July 2017 Income and Outlays

Submitted by Atlas Indicators Investment Advisors on September 5th, 2017

Both income and outlays improved as the second half of 2017 got started according to the Bureau of Economic Analysis. After no change in June, personal income increased 0.4 percent in July. Personal consumption expenditures (PCE) grew as well, rising 0.3 percent after advancing 0.2 percent in the prior period (upwardly revised from 0.1 percent). Additionally, inflation data within the report remained lethargic.

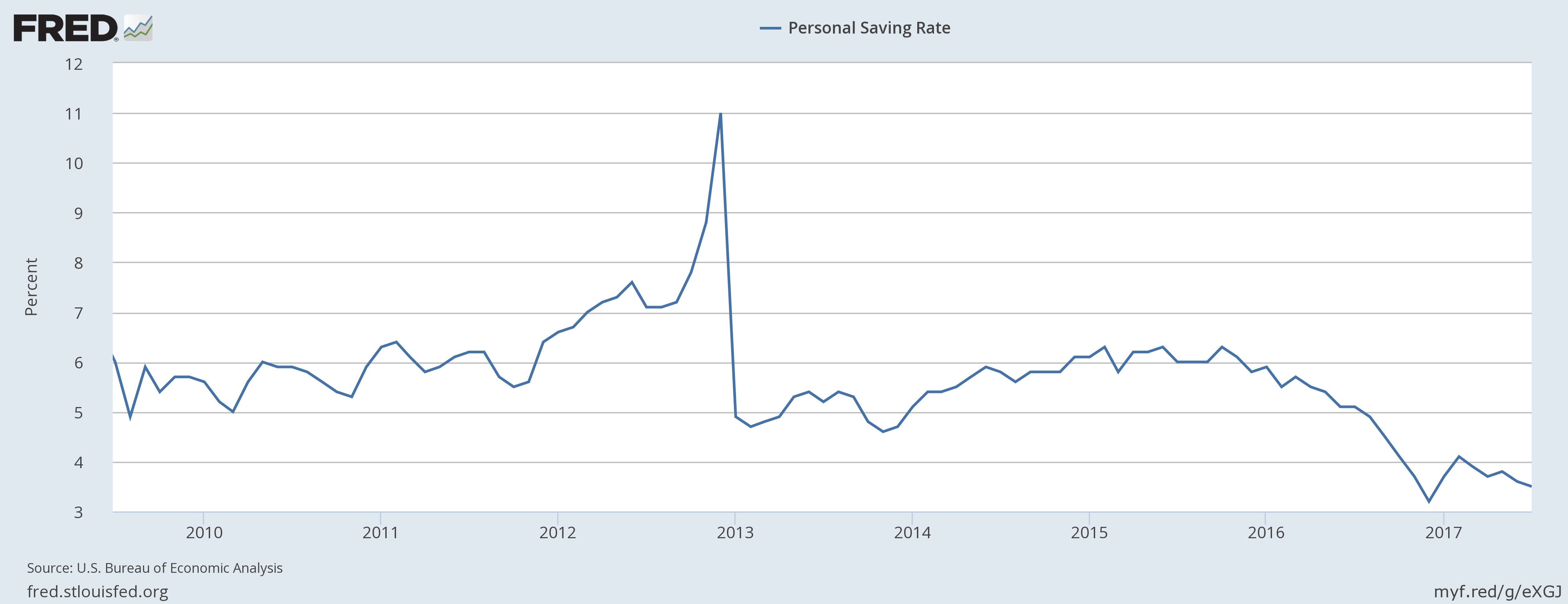

All four major categories of income rose in the period. Wages and salaries increased 0.5 percent according to this survey. Proprietors’ profits rose 0.2 percent. Income from rents rose 0.4 percent and receipts on assets (think interest and dividends) increased 0.5 percent. After taxes are paid on income, we are left with disposable income which rose just 0.3 percent in the period. Since take-home pay increased at roughly the same rate as spending (PCE) in the period, the nation’s savings rate suffered, falling to just 3.5 percent from 3.6 percent in June. Personal savings is nearing its lowest level since the end of the Great Recession.

Inflation data continued its relative weakness. Atlas uses the term "relative" because the Federal Reserve has been trying to stimulate inflation for years, and their explicit target of 2.0 percent continues to elude them. During July, the PCE price index increased just 0.1 percent and is 1.4 percent higher than a year earlier. Excluding food and energy, leaving the Federal Reserve’s favorite measure of prices, the core PCE price index was also up 0.1 percent and 1.4 percent on a monthly and annual basis respectively.

July was a mixed month for this indicator. Growing incomes and expenditures are good for an economy like America's, two-thirds of which is comprised of individual consumption. However, the added after-tax spending came at a cost to the savings rate which is not helpful in the long-run. Further, the Federal Reserve is in the process (albeit at a very slow pace) of removing their accommodative policies from the economy and inflation is still not cooperating with their efforts. America’s economic expansion is continuing, but this important indicator is not suggesting further acceleration is a foregone conclusion.