Feeling for the Fed

Submitted by Atlas Indicators Investment Advisors on July 31st, 2023

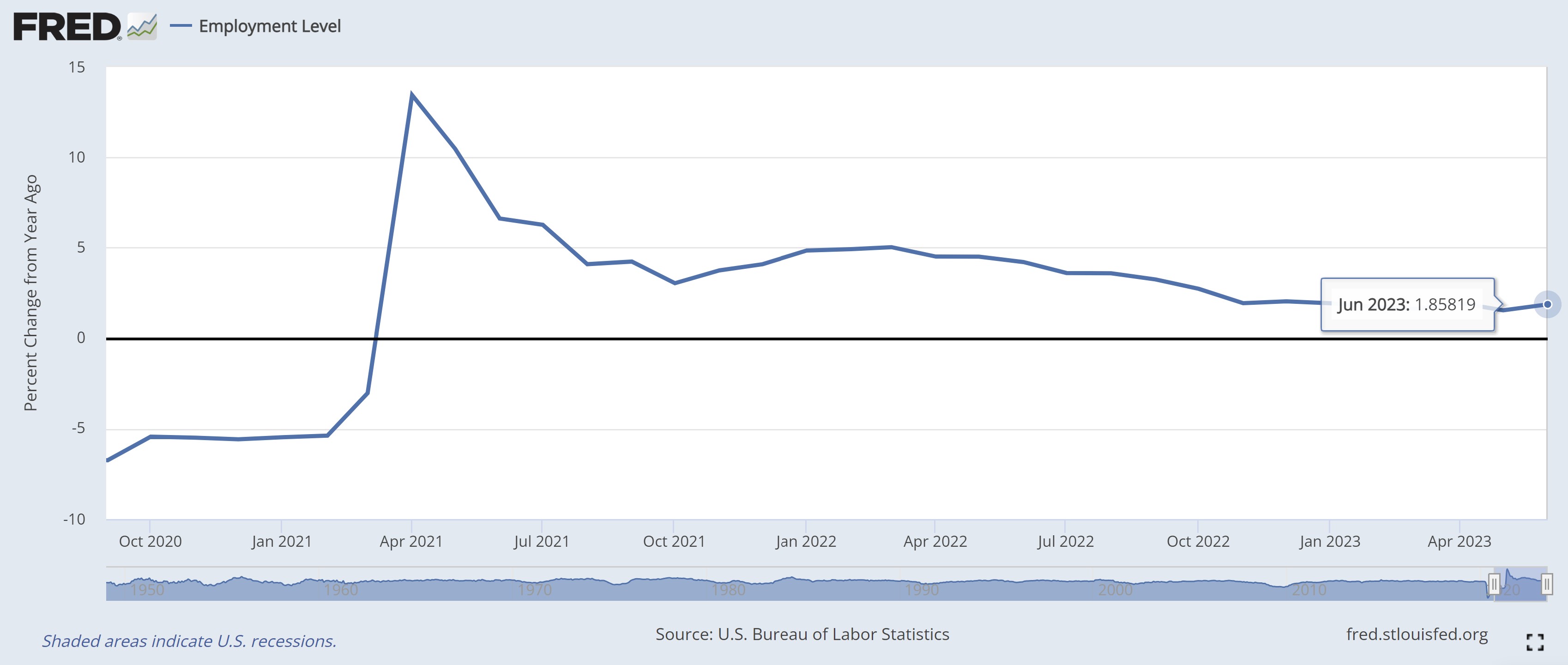

Employment data have been rather consistent during the past year or so and could be setting up the Federal Reserve for a period of difficulty. Growing payrolls have been the trend every month since December 2020. The year-over-year statistic has been above zero since April 2021. Although, it has also been decelerating since then (see the chart above), partly due to the law of large numbers. Finally, the unemployment rate has been between 3.4 percent and 3.7 percent since March 2022. From the looks of it, America is virtually fully employed.

The current consistency of America’s employment situation leaves inflation as the Federal Reserve’s primary concern. Its trend peaked in June 2022 and has been steadily moving lower since. Suggestions that a soft-landing (i.e., avoiding recession) is at hand are increasing as well. Has the Fed licked inflation without a major disruption to the economy and jobs market? Time will tell, but markets are unclear. Bonds still suggest a difficult time ahead as the yield curve remains inverted. Meanwhile, equity markets are looking past the signal, suggesting things are ok. What is the Federal Reserve to do?

Expectations are for a small hike later today, but then the inflation data get more challenging. June 2022 data will no longer be on the trailing twelve-month lookback. That means, all else equal, that it will be more difficult for the trend to fall further in the months ahead. If there’s a silver lining for monetary policy makers, it is that they don’t meet again until they get to see the July Personal Consumption Expenditures Price Index as well as Consumer Price Index data for both July and August. Should those continue decelerating on a year-over-year basis, the central banks may just take a victory lap.