Celestial Cycles and Societal Scores

Submitted by Atlas Indicators Investment Advisors on March 31st, 2024

Do you have a favorite constellation? I do: Orion. I cannot explain why, but it brings me so much pleasure when it begins appearing in the night sky each year. The formation has been on my mind lately because it is starting to say goodbye until reemerging in the fall. On Wednesday it dawned on me that Betelgeuse was back to full brightness after an event now known as the Great Dimming. A casual search for what happened led me to an article about another star which is likely to appear between now and September: T Coronae Borealis. While not a new star, it will be new to us, since it hasn’t been visible since 1946 and 1866 before then.

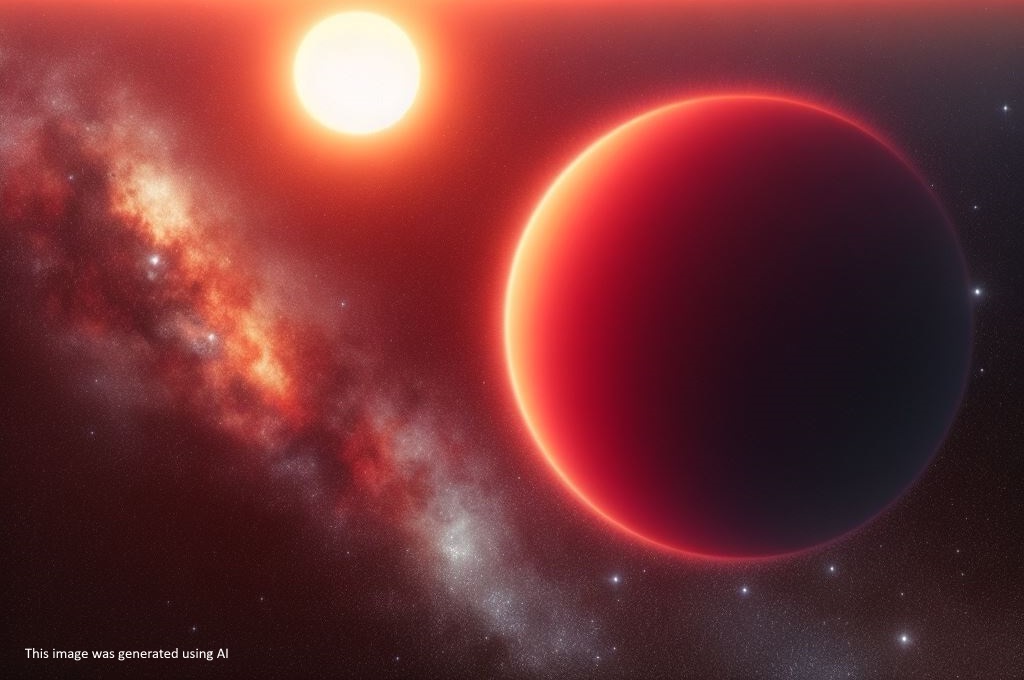

Also known as the Blaze Star, this celestial phenomenon is a recurrent nova system in the constellation Corona Borealis. It’s actually a star system comprised of a red giant and white dwarf star. What is expected to happen is that the red giant will begin casting its outer layers off as matter onto the white dwarf. The smaller companion will then heat up even more than is typical, creating a “runaway thermonuclear reaction,” causing it to brighten enough for humans in the northern hemisphere to see with the naked eye.

Yeah, but what does this have to do with economics? Well, it’s a stretch but this roughly 80-year cycle then reminded me of the four repeating cycles know as turnings, a term coined by authors William Strauss and Neil Howe. In short, they suggest the history of society unfolds in fairly predictable 80-year cycles. As it happens, these larger periods coincide with the reappearance of the Blaze Star. Right around the same time that the binary eruptions begin, society seems to be in the midst of its own eruptions. In 1866, America was still dealing with the aftermath of its Civil War. And in 1946, the globe was trying to reestablish order after World War II. American and global economics are impacted by such conflicts.

It's unclear to Atlas as to why the Blaze Star is expected in just 78 years. Like Strauss and Howe, the scientific community must see a pattern emerging from the celestial system. While we anxiously await the short-lived pulses in the night sky, we would be ok if larger societal disruptions like those from its prior two appearances are held at bay.