What, Exactly, Is In Your Wallet?

Submitted by Atlas Indicators Investment Advisors on February 29th, 2024

The New York Fed’s latest quarterly report on household debt and credit revealed some worrying trends in the U.S. economy. Credit card and auto loan delinquencies surged in 2023, indicating increased financial stress among consumers, especially younger and lower-income households. Meanwhile, the amount of money in money market instruments reached an all-time high, perhaps showing two realities in America.

According to the report, credit card debt that moved into serious delinquency (90 days or more past due) amounted to 6.4 percent in the fourth quarter of 2023, a 59 percent jump from just over four percent at the end of 2022. The quarterly increase at an annualized pace was around 8.5 percent, the highest since the Great Recession. Auto loan delinquencies also rose to 7.3 percent in the same period, above pre-pandemic levels. These trends signal that many consumers are struggling to repay their debts, which could have negative implications for their credit scores, access to credit, and, therefore, future consumption.

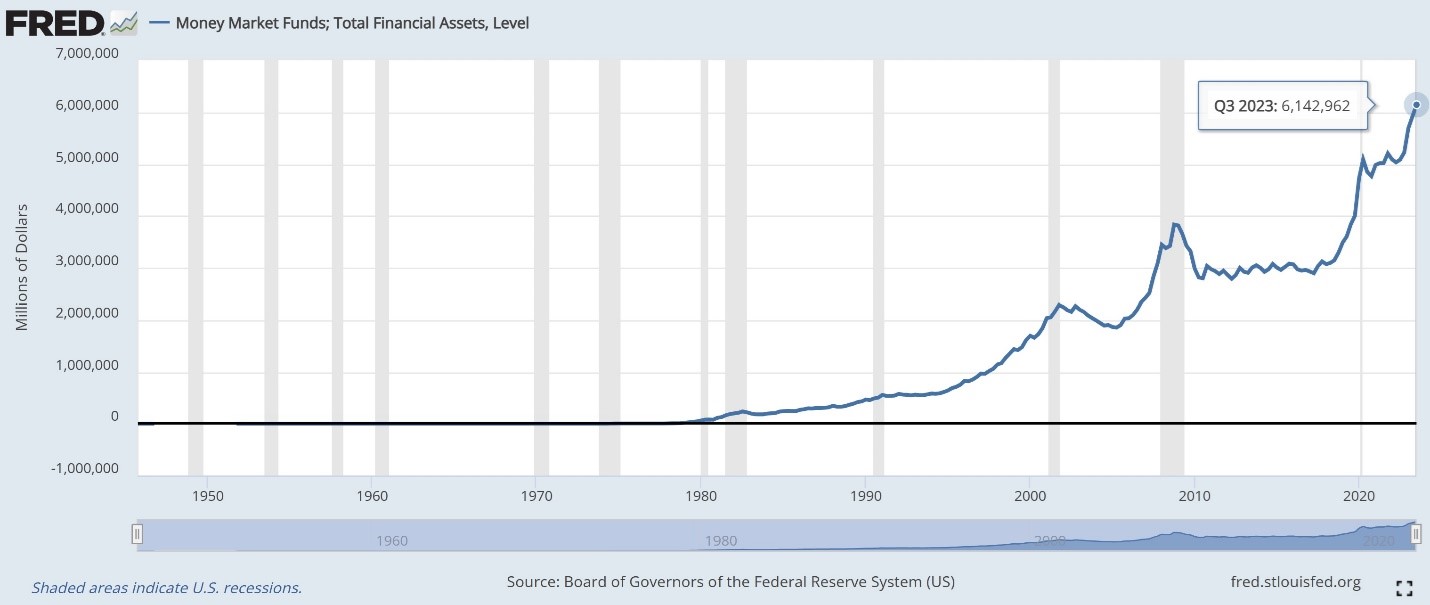

On the other hand, the amount of money in money market instruments, which are short-term securities that provide low-cost capital for businesses, banks, and governments, reached over $6.1 trillion in late 2023, the highest level ever recorded (see chart). While those challenged to make payments on debt are hindered further by the rising rates in the past few years, others are enjoying interest rates on relatively safe and highly liquid assets, buttressing their net worth.

It's tough to know what the divergence between the rising delinquencies and soaring assets in money markets means for the U.S. economy. Yes, many will struggle which hurts the aggregate economic statistics. On the other hand, America’s wealthiest households do the majority of spending, so their interest income may do even more to support further consumption (ask me about propensity to spend if you want to push back on this idea, however). What will be interesting to watch in the coming months and quarters is how leaders in Washington D.C., both those elected and those at the central bank, possibly react if this indeed is happening.