Second Quarter 2020 Advanced Gross Domestic Product

Submitted by Atlas Indicators Investment Advisors on August 4th, 2020

As far as economic indicators go, gross domestic product (GDP) from the Bureau of Economic Analysis (BEA) is probably one of the most popular. Despite the attention this comprehensive look at American output receives, it offers some of the oldest data available in a new release when it is published because it includes information as old as the first month from the previous quarter. For instance, the latest release from last week includes data from as far back as April of this year.

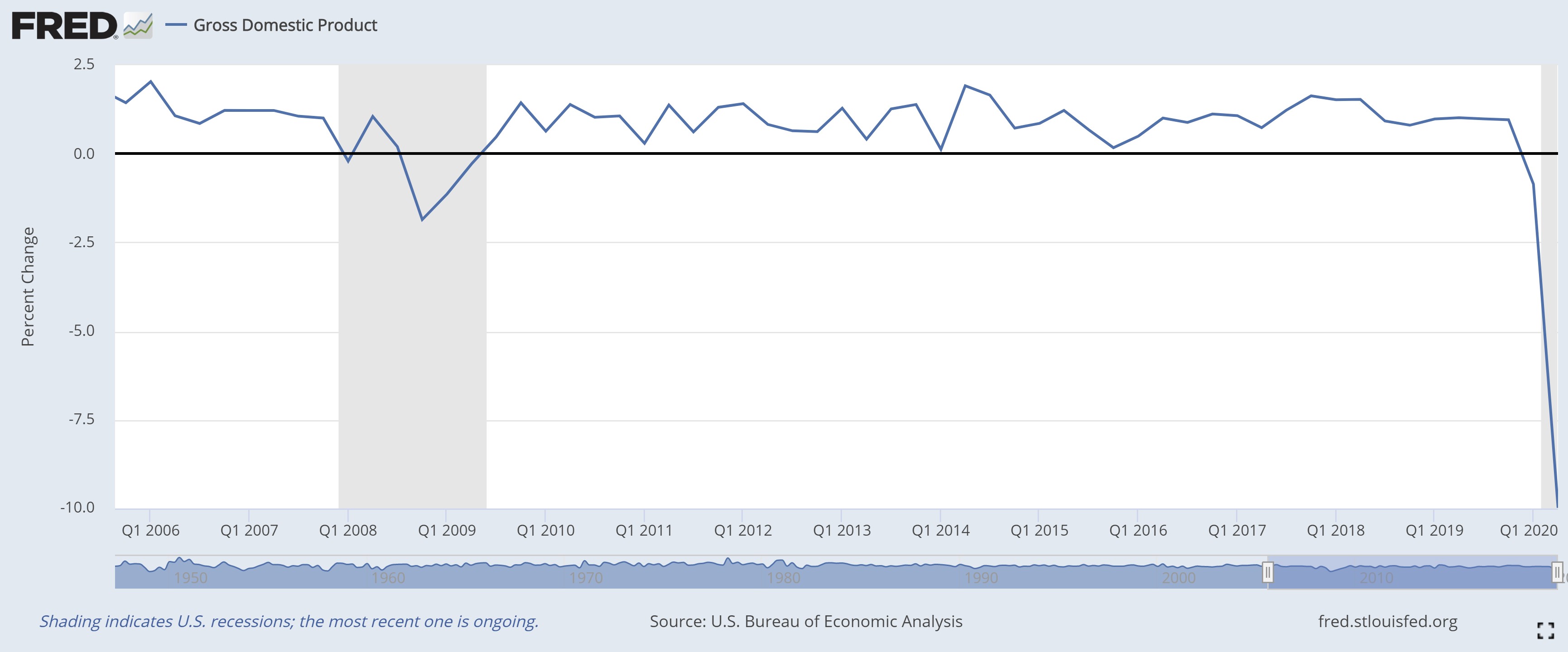

While data in the latest GDP report is hardly ancient, it is historic. As our nation grappled with the coronavirus pandemic, economic output declined 32.9 percent on an annualized basis. This is the steepest decline in the postwar era. In no uncertain terms, this was bad, but America reports GDP differently than the rest of the world, so it looks even worse. Our BEA annualizes the data instead of simply reporting it on a quarter-over-quarter basis. If we calculated it the way other nations tally theirs, the downtick was 9.49 percent.

Getting rid of the annualizing does not diminish the historic nature of the downturn but gives us a clearer understanding as to where the economy is compared to this year’s first quarter. Output declined then as well, off an annualized 5.0 percent. On a quarterly basis, the economy contracted 1.27 percent during January through March of this year. Said another way, from April through June of this year, our economy produced 10.65 percent less than its all-time peak recorded at the end of 2019

Pollyannaish hardly describes Atlas. We aren’t trying to soft pedal the dramatic downturn. Make no mistake, it was a terrible first half of the year. But given how these calculations are made, don’t be surprised to see a dramatic uptick in this year’s third quarter numbers barring another severe exogenous shock. Atlas calls this bear market math. This statistic’s gyrations may be confusing. It could be one to two years before these large swings begin to fade, providing a clearer perspective.