Revised First Quarter 2019 Gross Domestic Product

Submitted by Atlas Indicators Investment Advisors on June 17th, 2019

Output growth in America during the first quarter of 2019 was downwardly revised by the Bureau of Economic Analysis in their second estimate of the period’s Gross Domestic Product. After more data were collected, output is estimated to have grown 3.1 percent on an annualized basis, down from 3.2 percent in the first iteration.

As is normally the case, the revisions were mixed. On the plus side, personal consumption increased faster than first calculated, rising 1.3 percent versus 1.2 percent; consumption of both durable and nondurable goods slowed a little less than first reported, and services increased marginally faster. However, business investment received a hefty downgrade. Investment grew by 4.3 percent instead of the earlier estimate of 5.1 percent; equipment and residential investment were the big difference makers. Equipment was revised to minus one percent from positive 0.2 percent, and residential investment declined 3.5 percent versus the earlier estimate of minus 2.8 percent. Exports were 1.1 percentage points higher than in the first count, but imports offset this by being 1.2 percentage points higher (remember they subtract from the total). Finally, government spending was increased 0.1 percentage point after more complete data were available.

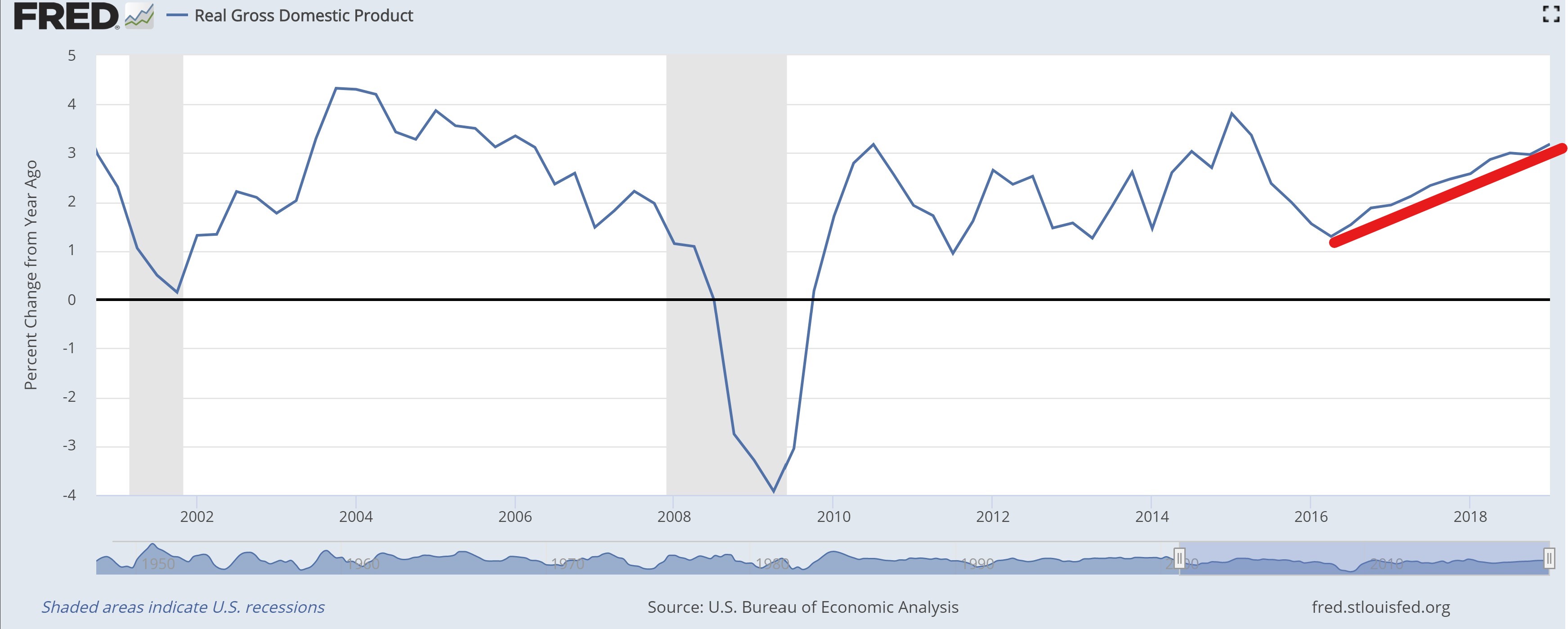

Despite this marginal downgrade, the economy appears to be in fairly good shape. For instance, it accelerated from 2.2 percent annualized growth to end last year to this 3.1 percent tally. Growth has also maintained a steady upward trajectory on a year-over-year basis since reversing up starting in the second quarter of 2016 (see the chart above). There are challenges facing our economy (e.g., geopolitics, inverted portions of the yield curve, and various trade skirmishes), but there have not been enough signs suggesting a new economic contraction is on the horizon just yet.