Positive Trajectories

Submitted by Atlas Indicators Investment Advisors on October 29th, 2024

Economies are large (especially the largest in the world) which makes them difficult to measure. Any measurements which are conducted are also subject to revisions. These revisions bring in more complete data, helping to improve the accuracy of the measurement.

Professionals at the Bureau of Economic Analysis (BEA) do their best to accurately represent the amount of output America is generating when they produce their quarterly Gross Domestic Product (GDP) figure. In short, it accounts for spending. It is the sum of consumer spending, business investment, government spending, and net exports. Since America imports a lot more than it exports, the net export figure is negative, so it subtracts from the other components.

Similarly, professionals at the BEA also try to quantify the other side of the coin from GDP, Gross Domestic Income (GDI). This is a look at 10 different components or forms of income in aggregate, attempting to total the amount of income generated while producing goods and services.

In theory, GDP and GDI measure the same output but from different vantage points and, therefore, should be the same. Of course, statistics cannot measure everything all the time. Instead, these samples create maps, helping observers understand the nature of the entire picture without having to observe it all. From this data, inferences may be made about the larger data set which cannot be observed entirely.

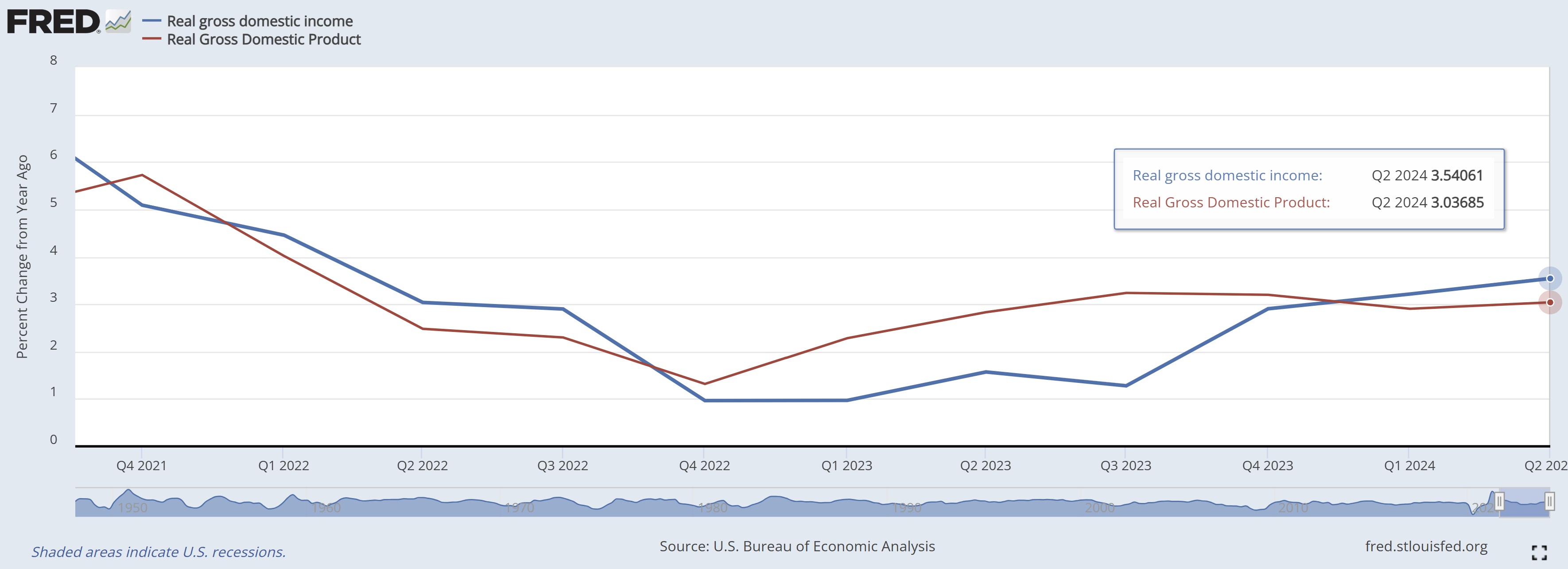

Currently, estimates of GDP and GDI show similar patterns. The economy accelerated in the second quarter for both of these measures. GDI (the blue line above) seems to have gotten off to a slower start following fourth quarter 2022 but is now continuing to climb higher on a year-over-year basis. Whether GDP catches up is unknowable at this point. Instead, the primary takeaway Atlas sees in the chart is that both are heading higher. Add to that some of the fuel pumped into the economy by the Federal Reserve earlier this month, and one might argue more growth is likely. At the very least, it makes it difficult to suggest that an economic downturn is underway. We’ll know more later this month on how these two looks at the overall economy fared in the third quarter of this year. If they continue the climb, further interest rate cuts from the central bank will come into question.