Mounting Debts

Submitted by Atlas Indicators Investment Advisors on November 30th, 2023

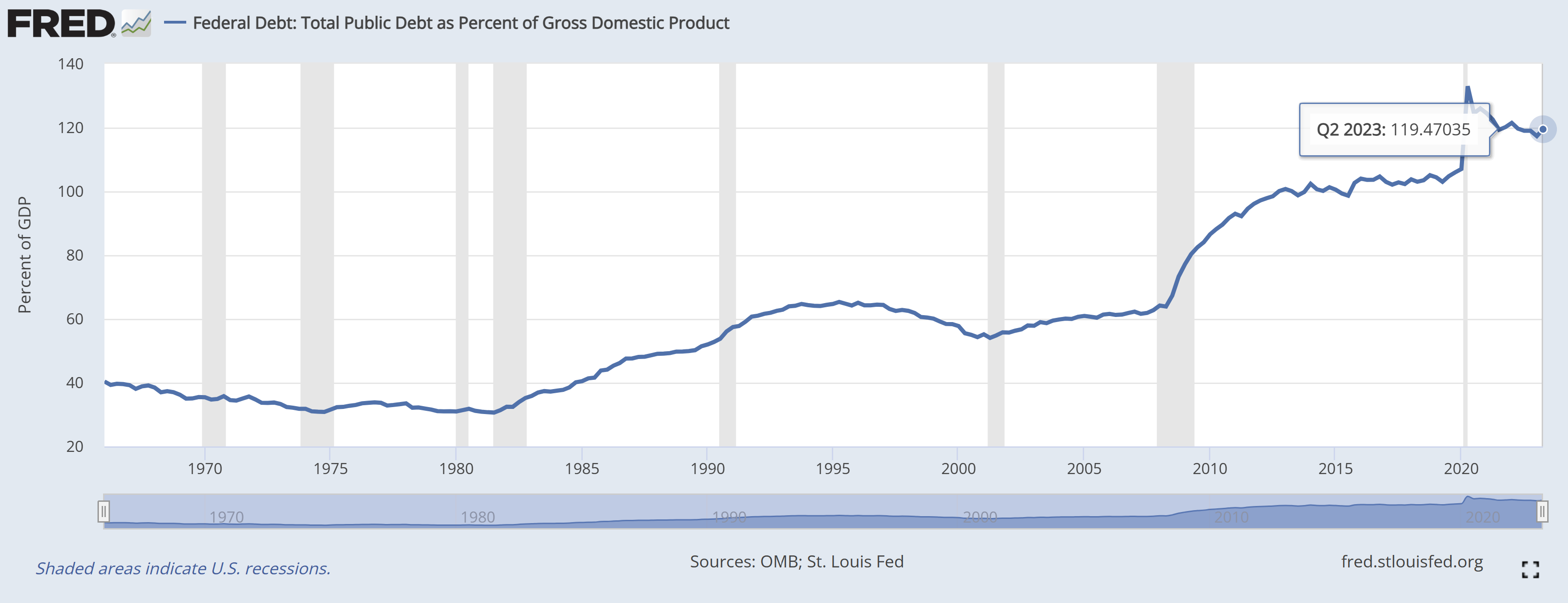

National debts are interesting. There’s myriad of opinions on them. America’s is at another all-time high, and some folks are worried. Their concern, of course, is countered by others who are less so. It was recently brought to Atlas’ attention that in the past year, the debt on America’s balance sheet rose more than three times the 2008 bailout in order to fund deficits. Make no mistake, that is a lot. Should we be worried? It depends on who you ask.

Some people believe there is virtually no limit for a nation with America’s capacity to go into debt. This cohort tends to argue that they’ll just do what they always do and print more money to service the debt, thereby issuing more IOUs. These folks don’t tend to be overly concerned about the crowding out effect that can happen when the government absorbs too much of the available capital within an economy.

Others are less sanguine. They worry about a looming fiscal crisis, believing a loss of confidence among large investors could push borrowing costs up across the economy. This tends to be tied to inflation fears as well. The idea that too much money chasing too few goods can be created by a further uptick in borrowing.

These are all potential outcomes. We’ll never know exactly how things unfold until they already have. It is worth making some comments about the balance sheet growth mentioned above. Comparisons to the 2008 crisis are always scarier because that was such a difficult time for the financial system in America. There’s also a different context today with that level of borrowing. For instance, the economy is much larger than then, so it should have some increased capacity for debt. It also doesn’t take into consideration what other nations are doing, which matters because debts and currencies exist in a relative world. As you can see above, America’s debt-to-GDP ratio is 119.5 percent as of the second quarter of this year. In Japan, that figure is closer to 225 percent.