June 2017 Industrial Production

Submitted by Atlas Indicators Investment Advisors on July 18th, 2017

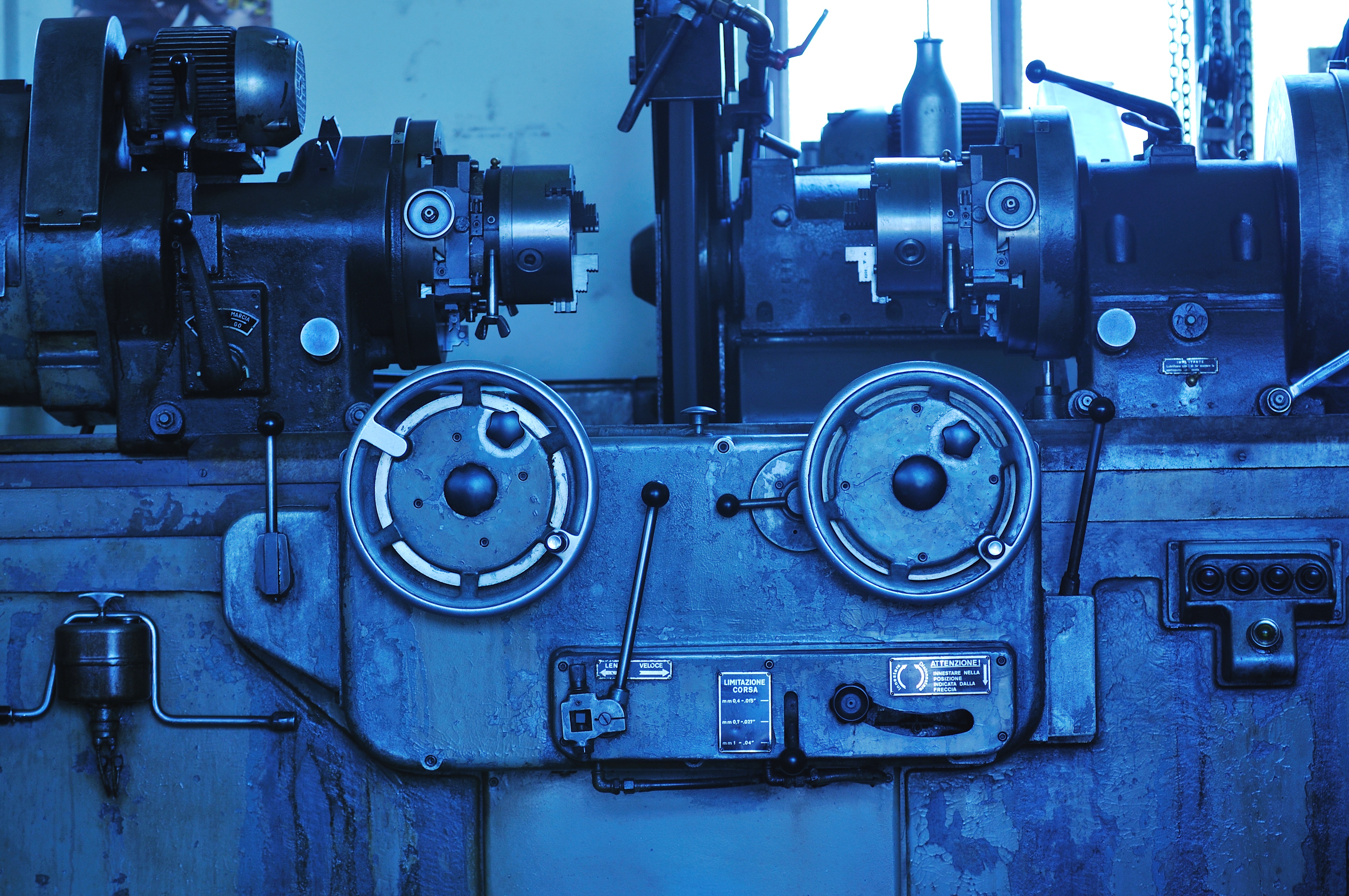

Increasing for a fifth consecutive period, industrial production rose 0.4 percent in June 2107. Released by the Federal Reserve, this indicator measures everything physically produced in America, from paperclips to sophisticated aerospace equipment. Also included in the release is capacity utilization which quantifies how much of the country’s resources for physical output are being used; it increased to 76.6 percent from the downwardly revised count of 76.4 percent (originally 76.6 percent) seen in May.

Two of the three major industry groups increased, and one remained unchanged. Manufacturing gained back some of the previous month’s loss of 0.4 percent, growing 0.2 percent in June; durable goods led the advance while nondurables were unchanged. Mining output increased for the third consecutive period, rising 1.6 percent after surging 1.9 percent a month earlier. Mining is currently 9.9 percent higher than a year ago but remains 9.0 percent below its peak in December 2014; oil and gas extractions as well as coal mining is leading the category higher. Finally, output by utilities held steady in the period as a decline in gas usage was offset by an increase in electricity consumption.

Industrial production may be starting to accelerate after contributing relatively little to our economy’s growth. After peaking in June 2010, this indictor’s year-over-year rate of change began decelerating and then contracted for 18 months. Finally, in March of this year, its trend began accelerating and is now at its best reading since January 2015. While two percent is not exciting on its own, since it has maintained higher levels for extended periods in previous expansions, the recent acceleration is encouraging.