April 2019 Personal Income and Outlays

Submitted by Atlas Indicators Investment Advisors on June 17th, 2019

Personal income and outlays improved in April 2019 according to the latest data from the Bureau of Economic Analysis. Following an uptick of just 0.1 percent in March, pay in America rose 0.5 percent to start the second quarter. On the other side of the ledger, spending improved but did so at a slower pace; outlays gained 0.3 percent in April, and the prior period’s tally was upwardly revised to 1.1 percent from 0.9 percent. Also, disposable income (after-tax) increased 0.4 percent.

Income categories were mixed but mostly improved. Starting with the largest segment, wages and salaries were up 0.3 percent after rising 0.4 percent in March. Proprietors’ income was virtually flat after declining 1.0 percent to end the first quarter. Rental income slowed from a gain of 1.0 percent to an uptick of 0.2 percent. Personal income on assets managed to gain back some of their losses experienced in the prior three months, rising 1.6 percent.

Outlays were also mixed in the period, but they were biased slightly lower. Spending on goods eked out a gain of 0.1 percent; however, durable goods fell 0.4 percent but were offset by an uptick of 0.3 percent for purchases of nondurable wares. Service outlays had a rare setback, declining 0.1 percent after being higher in every prior month this year.

America’s savings rate improved marginally. After being as high as 7.4 percent in December 2018, it fell to 6.1 percent in March and is now at 6.2 percent.

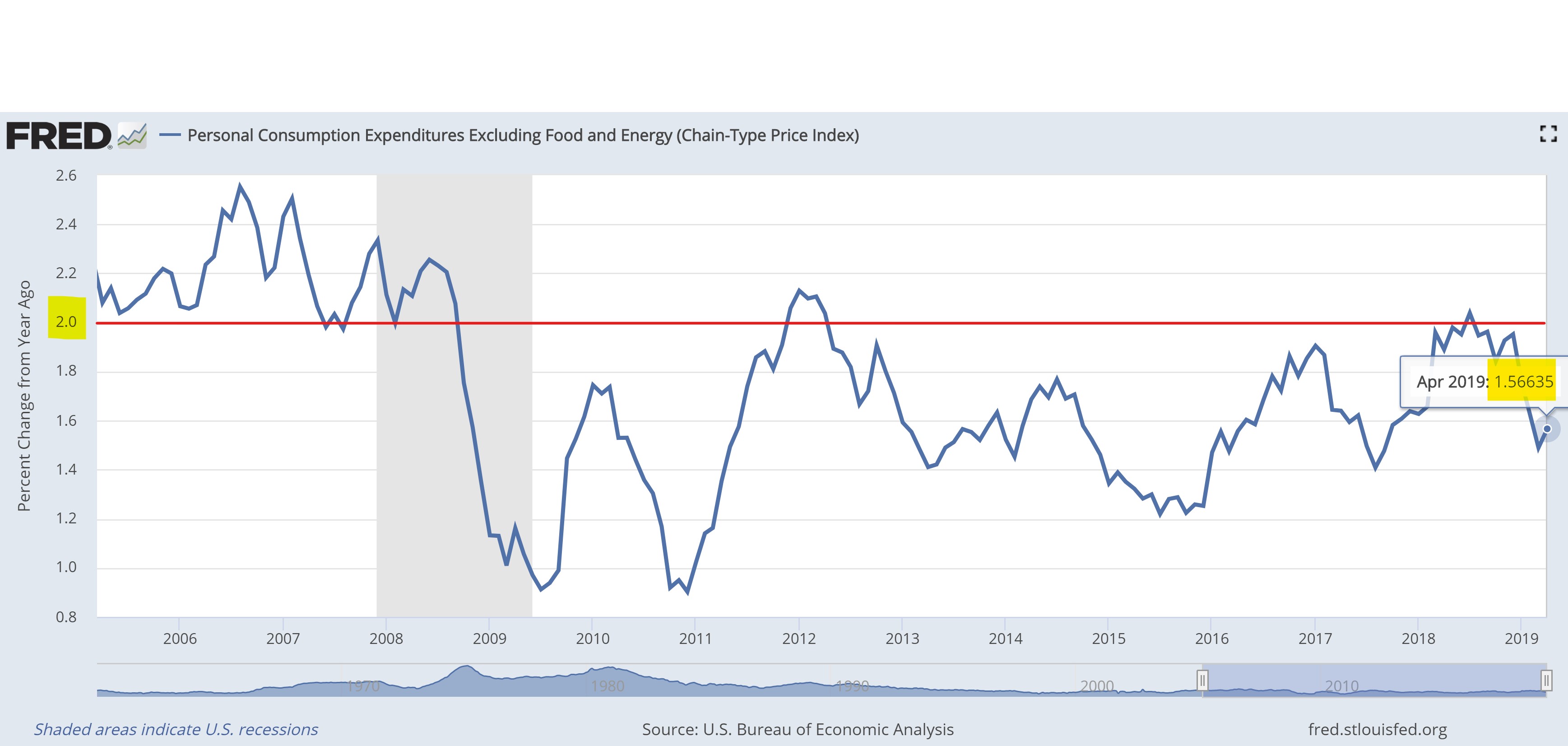

Important data on inflation is also included in this release. The Personal Consumption Expenditure Price Index (PCE) gained 0.3 percent. The core PCE (it removes food and energy since they are volatile) was up 0.2 percent after being up just 0.1 percent in the prior period. Year-over-year, the PCE and core PCE were up 1.5 percent and 1.6 percent respectively.

This release was mostly positive, but inflation data are probably frustrating the Federal Reserve. For instance, the big stuff, incomes and outlays, are growing, but inflation continues to be lower than their self-prescribed target of 2.0 percent, as it has been for virtually all of America’s current expansion. Chair Jay Powell and the other central bankers meet today and tomorrow, so we should hear more about the planners’ thoughts when Mr. Powell addresses the media shortly after the Fed’s committee adjourns on Wednesday.