Advanced Estimate of Second Quarter 2019 GDP

Submitted by Atlas Indicators Investment Advisors on August 13th, 2019

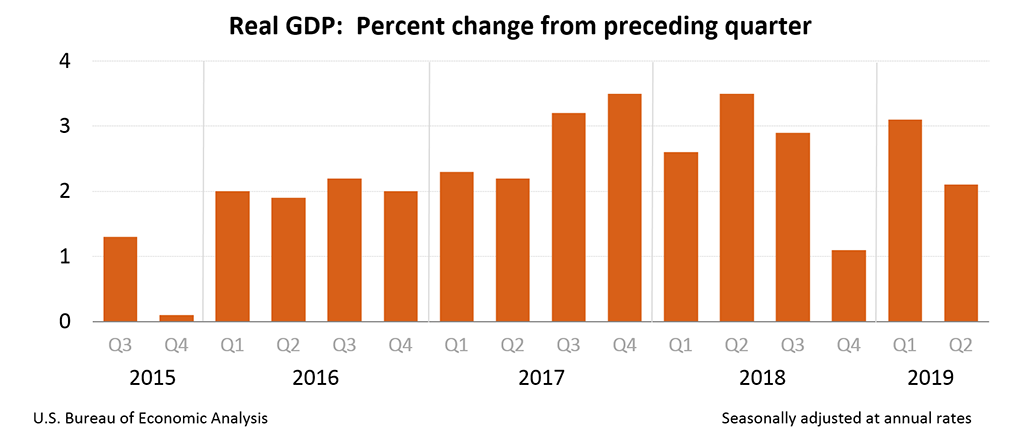

Economic output continued growing in the second quarter of 2019 according to the advance estimate of Gross Domestic Product (GDP) from the Bureau of Labor Statistics. However, the economy decelerated to a 2.1 percent annualized pace of growth from 3.1 percent in the January through March period of this year. This is the first look at the data, and two revisions will come out in the months ahead as more complete data are collected. In the meantime, let’s look at some of the details.

Consumers are leading the growth of this economy. Domestic final sales (GDP minus net exports and inventory changes) gained 3.5 percent. Part of the domestic final sales tally are personal consumption expenditures (PCE) which advanced 4.3 percent, recording the strongest tally since the final three months of 2017. More specifically, spending on goods led the tally with a strong 8.3 percent annualized gain, which included a 12.9 percent jump for durable goods. Services were up a much more subdued 2.5 percent, but that is better than the previous two quarters combined. Government spending also helped boost domestic final sales, rising 5.5 percent, while net export changes were nominal.

Business investment was a drag on the total. Fixed investment fell 5.5 percent as outlays for nonresidential structures plummeted 10.6 percent, and equipment investments gained just 0.7 percent. Intellectual property gained 4.7 percent; while in absolute terms it looks healthy, it is a drastic deceleration from the prior two quarters’ double-digit gains.

This iteration of GDP looks relatively out of balance. It is true consumers are the American economy’s primary driver, but they cannot always be the sole source of growth. However, for now they are willing to keep the economy moving forward, and we have you to thank in part for that. America’s output growth will benefit from firms accelerating their investments, especially if consumers start to show signs of fatigue.